Aflac 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

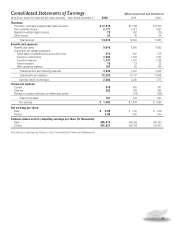

Consolidated Statements of Comprehensive Income Aflac Incorporated and Subsidiaries

(In millions) Years Ended December 31, 2006 2005 2004

Net earnings $ 1,483 $ 1,483 $ 1,266

Other comprehensive income (loss) before income taxes:

Foreign currency translation adjustments:

Change in unrealized foreign currency translation gains (losses) during year (12) 44 (24)

Unrealized gains (losses) on investment securities:

Unrealized holding gains (losses) arising during year (642) (538) 143

Reclassification adjustment for realized (gains) losses included in net earnings (79) (262) 12

Pension liability adjustment during year (64) (13) 14

Total other comprehensive income (loss) before income taxes (797) (769) 145

Income tax expense (benefit) related to items of other

comprehensive income (loss) (266) (115) 28

Other comprehensive income (loss), net of income taxes (531) (654) 117

Total comprehensive income $ 952 $ 829 $ 1,383

See the accompanying Notes to the Consolidated Financial Statements.

1. SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Description of Business: Aflac Incorporated (the Parent

Company) and its subsidiaries (the Company) primarily sell

supplemental health and life insurance in the United States

and Japan. The Company’s insurance business is marketed and

administered through American Family Life Assurance

Company of Columbus (Aflac), which operates in the United

States (Aflac U.S.) and as a branch in Japan (Aflac Japan). Most

of Aflac’s policies are individually underwritten and marketed

through independent agents. Our insurance operations in the

United States and our branch in Japan service the two markets

for our insurance business. Aflac Japan accounted for 72% of

the Company’s total revenues in 2006, 74% in 2005 and 75%

in 2004, and 82% of total assets at both December 31, 2006

and 2005.

Basis of Presentation: We prepare our financial statements in

accordance with U.S. generally accepted accounting principles

(GAAP). These principles are established primarily by the

Financial Accounting Standards Board (FASB). The preparation

of financial statements in conformity with GAAP requires us to

make estimates when recording transactions resulting from

business operations based on currently available information.

The most significant items on our balance sheet that involve a

greater degree of accounting estimates and actuarial

determinations subject to changes in the future are the

valuation of investments, deferred policy acquisition costs, and

liabilities for future policy benefits and unpaid policy claims.

These accounting estimates and actuarial determinations are

sensitive to market conditions, investment yields, mortality,

morbidity, commission and other acquisition expenses, and

terminations by policyholders. As additional information

becomes available, or actual amounts are determinable, the

recorded estimates will be revised and reflected in operating

results. Although some variability is inherent in these

estimates, we believe the amounts provided are adequate.

The consolidated financial statements include the accounts of

the Parent Company, its majority-owned subsidiaries and those

entities required to be consolidated under applicable

accounting standards. All material intercompany accounts and

transactions have been eliminated.

Translation of Foreign Currencies: The functional currency

of Aflac Japan’s insurance operations is the Japanese yen. We

translate our yen-denominated financial statement accounts

into U.S. dollars as follows. Assets and liabilities are translated

at end-of-period exchange rates. Realized gains and losses on

security transactions are translated at the exchange rate on the

trade date of each transaction. Other revenues, expenses and

cash flows are translated using average exchange rates for the

year. The resulting currency translation adjustments are

reported in accumulated other comprehensive income. We

include in earnings the realized currency exchange gains and

Notes to the Consolidated Financial Statements