Aflac 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

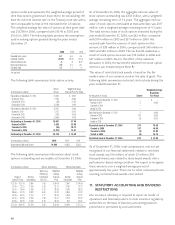

Income tax expense in the accompanying statements of

earnings varies from the amount computed by applying the

expected U.S. tax rate of 35% to pretax earnings. The principal

reasons for the differences and the related tax effects for the

years ended December 31 were as follows:

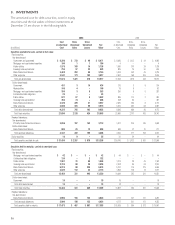

(In millions) 2006 2005 2004

Income taxes based on U.S. statutory rates $ 792 $ 779 $ 632

Utilization of foreign tax credit carryforwards (21) (20) (18)

Release of valuation allowance on deferred tax assets –(34) (128)

Nondeductible expenses 10 10 6

Other, net –815

Income tax expense $ 781 $ 743 $ 507

Total income tax expense for the years ended December 31,

was allocated as follows:

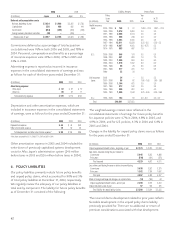

(In millions) 2006 2005 2004

Statements of earnings $ 781 $ 743 $ 507

Other comprehensive income:

Changes in unrealized foreign currency

translation gains/losses 10 188 (32)

Pension liability adjustment (22) (2) 5

Unrealized gains on investment securities:

Unrealized holding gains (losses)

arising during the year (226) (206) 61

Reclassification adjustment for realized

(gains) losses included in net earnings (28) (95) (6)

Total income tax expense (benefit) allocated

to other comprehensive income (266) (115) 28

Additional paid-in capital (exercise of stock options) (18) (37) (1)

Total income taxes $ 497 $ 591 $ 534

Changes in unrealized foreign currency translation

gains/losses included deferred income tax expense of $11

million in 2006, compared with deferred income tax expense

of $122 million in 2005 and deferred income tax benefit of

$31 million in 2004.

The income tax effects of the temporary differences that

gave rise to deferred income tax assets and liabilities as of

December 31 were as follows:

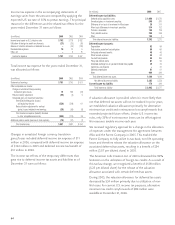

(In millions) 2006 2005

Deferred income tax liabilities:

Deferred policy acquisition costs $ 1,680 $ 1,576

Unrealized gains on investment securities 596 876

Difference in tax basis of investment in Aflac Japan 25 311

Other basis differences in investment securities 314 132

Premiums receivable 135 128

Policy benefit reserves 388 248

Other 154 1

Total deferred income tax liabilities 3,292 3,272

Deferred income tax assets:

Depreciation 92 99

Policyholder protection fund obligation 66 66

Unfunded retirement benefits 45 45

Other accrued expenses 55 52

Tax credit carryforwards 80 235

Policy and contract claims 61 93

Unrealized exchange loss on yen-denominated notes payable 35 33

Capital loss carryforwards –21

Deferred compensation 81 51

Other 494 349

Total deferred income tax assets 1,009 1,044

Net deferred income tax liability 2,283 2,228

Current income tax liability 179 349

Total income tax liability $ 2,462 $ 2,577

A valuation allowance is provided when it is more likely than

not that deferred tax assets will not be realized. In prior years,

we established valuation allowances primarily for alternative

minimum tax credit and noninsurance loss carryforwards that

exceeded projected future offsets. Under U.S. income tax

rules, only 35% of noninsurance losses can be offset against

life insurance taxable income each year.

We received regulatory approval for a change in the allocation

of expenses under the management fee agreement between

Aflac and the Parent Company in 2005. This enabled the

Parent Company to fully utilize its tax-basis, non-life operating

losses and therefore release the valuation allowance on the

associated deferred tax assets, resulting in a benefit of $34

million ($.07 per diluted share) in 2005.

The American Jobs Creation Act of 2004 eliminated the 90%

limitation on the utilization of foreign tax credits. As a result of

this tax law change, we recognized a benefit of $128 million

($.25 per diluted share) for the release of the valuation

allowance associated with certain deferred tax assets.

During 2005, the valuation allowance for deferred tax assets

decreased by $34 million primarily due to utilization of non-

life losses. For current U.S. income tax purposes, alternative

minimum tax credit carryforwards of $80 million were

available at December 31, 2006.