Aflac 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

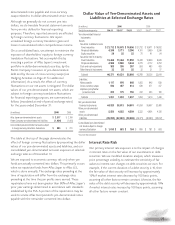

The estimated effect of potential increases in interest rates on

the fair values of debt securities we own, notes payable, cross-

currency swaps and our obligation for the Japanese

policyholder protection fund as of December 31 follows:

Changes in the interest rate environment have contributed to

the unrealized gains on debt securities we own. However, we

do not expect to realize a majority of these unrealized gains

because we have the intent and ability to hold these securities

to maturity. Likewise, should significant amounts of unrealized

losses occur because of increases in market yields, we would

not expect to realize these losses because we have the intent

and ability to hold such securities to maturity or recovery of

value. For additional information on unrealized losses on debt

securities, see Note 3 of the Notes to the Consolidated

Financial Statements.

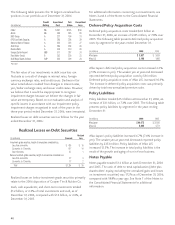

We attempt to match the duration of our assets with the

duration of our liabilities. The following table presents the

approximate duration of our yen-denominated assets and

liabilities, along with premiums, as of December 31.

The table at the top of the page shows a comparison of

average required interest rates for future policy benefits and

investment yields, based on amortized cost, for the years

ended December 31.

In response to low interest rates in the United States, we

lowered our required interest assumption for newly issued

products to 5.5% in 2005. In Japan, we lowered our required

interest assumption for some newly issued products to 2.5%

in 2005. However, the majority of Japan’s newly issued

products have a required interest assumption of 3.0%. We

continue to monitor the spread between our new money yield

and the required interest assumption for newly issued

products in both the United States and Japan and will re-

evaluate those assumptions as necessary.

Over the next two years, we have yen-denominated securities

that will mature with yields in excess of Aflac Japan’s current

net investment yield of 3.88%. These securities total $1.1

billion at amortized cost and have an average yield of 5.80%.

Currently, when debt securities we own mature, the proceeds

may be reinvested at a yield below that of the interest

required for the accretion of policy benefit liabilities on

policies issued in earlier years. As a result, securities that

mature may contribute to a decline in our overall portfolio

yield. However, adding riders to our older policies has helped

offset the negative investment spread. And despite negative

investment spreads, adequate overall profit margins still exist

in Aflac Japan’s aggregate block of business because of profits

that have emerged from changes in mix of business and

favorable experience from mortality, morbidity, and expenses.

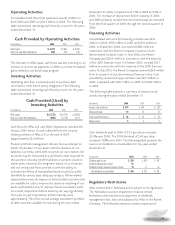

Investments and Cash

Our investment philosophy is to maximize investment income

while emphasizing liquidity, safety and quality. Our investment

objective, subject to appropriate risk constraints, is to fund

policyholder obligations and other liabilities in a manner that

enhances shareholders’ equity. We seek to achieve this objective

through a diversified portfolio of fixed-income investments that

reflects the characteristics of the liabilities it supports. Aflac

invests primarily within the debt securities markets.

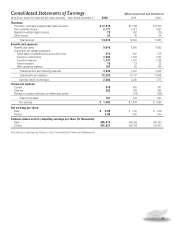

Sensitivity of Fair Values of Financial

Instruments to Interest Rate Changes

2006 2005

+100+

+100

Fair

Basis Fair Basis

(In millions) Value Points Value Points

Debt securities:

Fixed-maturity securities:

Yen-denominated $32,328 $28,712 $29,791 $26,427

Dollar-denominated 9,845 9,033 9,190 8,407

Perpetual debentures:

Yen-denominated 7,735 6,965 7,911 7,086

Dollar-denominated 698 653 711 661

Total debt securities $50,606 $45,363 $47,603 $42,581

Notes payable* $ 1,421 $ 1,386 $ 1,395 $ 1,362

Cross-currency and interest

rate swap liabilities $7$5 $12 $10

Japanese policyholder

protection fund $ 175 $ 175 $ 203 $ 203

*Excludes capitalized lease obligations

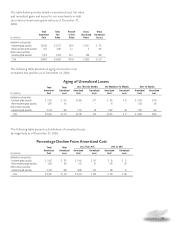

(In years)

2006 2005

Yen-denominated debt securities 13 12

Policy benefits and related expenses to be paid in future years 13 13

Premiums to be received in future years on policies in force 10 10

Comparison of Interest Rates for Future

Policy Benefits and Investment Yields

(Net of investment expenses)

2006 2005 2004

U.S. *Japan* U.S. *Japan* U.S. *Japan*

Policies issued during year:

Required interest on

policy reserves 5.50% 2.77% 5.50% 2.88% 6.36% 2.97%

New money yield on

investments 6.40 3.12 6.11 3.01 6.25 3.00

Policies in force during year:

Required interest on

policy reserves 6.28 4.71 6.36 4.79 6.40 4.87

Return on average

invested assets 6.86 3.88 6.54 3.92 6.68 4.02

*Represents yen-denominated investments for Aflac Japan that support policy obligations and

therefore excludes Aflac Japan’s annuities, and dollar-denominated investments and related investment income