Aflac 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

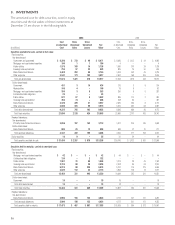

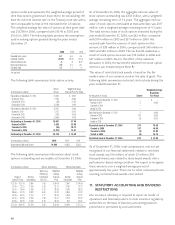

2006 2005

(In millions) Japan U.S. Japan U.S.

Deferred policy acquisition costs:

Balance, beginning of year $ 3,624 $ 1,966 $ 3,812 $ 1,783

Capitalization 556 492 562 441

Amortization (284) (290) (284) (258)

Foreign currency translation and other (39) – (466) –

Balance, end of year $ 3,857 $ 2,168 $ 3,624 $ 1,966

Commissions deferred as a percentage of total acquisition

costs deferred were 76% in both 2006 and 2005, and 78% in

2004. Personnel, compensation and benefits as a percentage

of insurance expenses were 44% in 2006, 41% in 2005 and

43% in 2004.

Advertising expense is reported as incurred in insurance

expenses in the consolidated statements of earnings and was

as follows for each of the three years ended December 31:

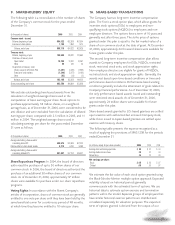

(In millions) 2006 2005 2004

Advertising expense:

Aflac Japan $82 $87 $70

Aflac U.S. 88 87 71

Total advertising expense $ 170 $ 174 $ 141

Depreciation and other amortization expenses, which are

included in insurance expenses in the consolidated statements

of earnings, were as follows for the years ended December 31:

(In millions) 2006 2005 2004

Depreciation expense $44 $44 $48

Other amortization expense 15 60 38

Total depreciation and other amortization expense* $59 $ 104 $ 86

*Aflac Japan accounted for $33 in 2006, $77 in 2005 and $60 in 2004.

Other amortization expense in 2005 and 2004 included the

write-down of previously capitalized systems development

costs for Aflac Japan’s administration system ($46 million

before taxes in 2005 and $26 million before taxes in 2004).

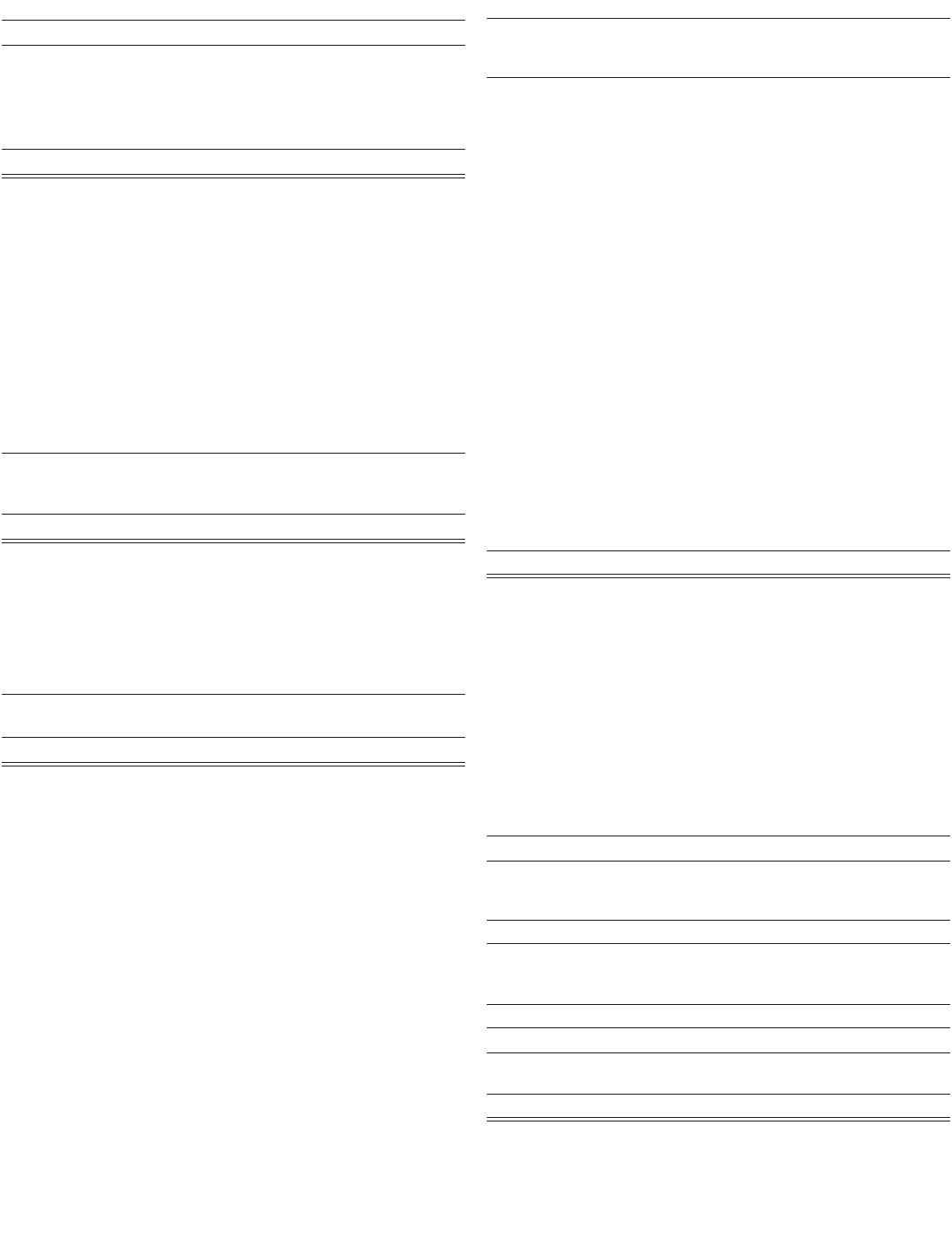

6. POLICY LIABILITIES

Our policy liabilities primarily include future policy benefits

and unpaid policy claims, which accounted for 90% and 5%

of total policy liabilities at December 31, 2006, respectively.

We regularly review the adequacy of our policy liabilities in

total and by component. The liability for future policy benefits

as of December 31 consisted of the following:

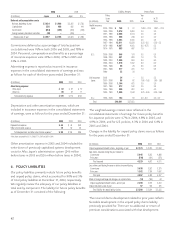

Liability Amounts Interest Rates

Policy Year

Issue of In 20

(In millions) Year 2006 2005 Issue Years

Health insurance:

Japan: 2005 - 2006 $ 148 $ 31 1.85% - 2.5% 1.85% - 2.5%

1999 - 2006 5,010 3,850 3.0 3.0

1997 - 1999 2,426 2,314 3.5 3.5

1995 - 1996 259 248 4.0 4.0

1994 - 1996 3,493 3,353 4.5 4.5

1987 - 1994 15,911 15,526 5.25 - 5.5 5.25 - 5.5

1978 - 1986 4,007 4,003 6.5 - 6.75 5.5

1974 - 1979 853 867 7.0 5.0

U.S.: 2005 - 2006 648 178 5.5 5.5

1998 - 2004 961 884 7.0 7.0

1988 - 2004 1,026 994 8.0 6.0

1986 - 2004 1,379 1,352 6.0 6.0

1985 - 1986 26 26 6.5 6.5

1981 - 1986 217 223 7.0 5.5

Other 33 36

Life insurance: 2006 24 – 2.5 2.5

Japan: 2001 - 2006 98 62 1.65 - 1.85 1.65 - 1.85

1999 - 2006 1,104 875 3.0 3.0

1997 - 1999 572 542 3.5 3.5

1994 - 1996 886 851 4.0 4.0

1985 - 1993 1,656 1,548 5.25 - 5.65 5.25 - 5.65

U.S.: 1956 - 2006 104 90 4.0 - 6.0 4.0 - 6.0

Total $ 40,841 $ 37,853

The weighted-average interest rates reflected in the

consolidated statements of earnings for future policy benefits

for Japanese policies were 4.7% in 2006, 4.8% in 2005, and

4.9% in 2004; and for U.S. policies, 6.3% in 2006 and 6.4% in

2005 and 2004.

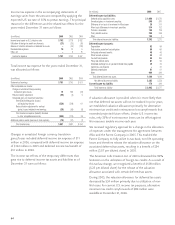

Changes in the liability for unpaid policy claims were as follows

for the years ended December 31:

(In millions) 2006 2005 2004

Unpaid supplemental health claims, beginning of year $ 2,375 $ 2,230 $ 2,008

Add claims incurred during the year related to:

Current year 5,045 5,203 4,886

Prior years (516) (401) (375)

Total incurred 4,529 4,802 4,511

Less claims paid during the year on claims incurred during:

Current year 3,435 3,352 3,270

Prior years 1,162 1,106 1,067

Total paid 4,597 4,458 4,337

Effect of foreign exchange rate changes on unpaid claims (14) (199) 48

Unpaid supplemental health claims, end of year 2,293 2,375 2,230

Unpaid life claims, end of year 97 129 125

Total liability for unpaid policy claims $ 2,390 $ 2,504 $ 2,355

The incurred claims development related to prior years reflects

favorable development in the unpaid policy claims liability

previously provided for. There are no additional or return of

premium considerations associated with that development.