Aflac 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

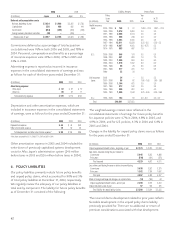

Unaudited Consolidated Quarterly Financial Data

In management’s opinion, this quarterly financial information fairly presents the results of operations for such periods and is

prepared on a basis consistent with our annual audited financial statements.

(In millions, except

for per-share amounts) March 31, 2006 June 30, 2006 September 30, 2006 December 31, 2006

Premium income $ 3,005 $3,093 $3,102 $3,114

Net investment income 524 542 548 557

Realized investment gains 14 50 11 5

Other income 16 12 11 11

Total revenues 3,559 3,697 3,672 3,687

Total benefits and expenses 2,984 3,073 3,115 3,180

Earnings before income taxes 575 624 557 507

Total income tax 200 216 190 175

Net earnings $ 375 $ 408 $ 367 $ 332

Net earnings per basic share $ .75 $ .82 $ .74 $ .67

Net earnings per diluted share .74 .81 .73 .67

March 31, 2005 June 30, 2005 September 30, 2005 December 31, 2005

Premium income $ 3,041 $ 3,020 $ 2,997 $ 2,931

Net investment income 514 518 522 517

Realized investment gains 3 11 140 108

Other income 1 18 10 11

Total revenues 3,559 3,567 3,669 3,567

Total benefits and expenses 3,053 3,051 3,024 3,008

Earnings before income taxes 506 516 645 559

Total income tax 178 180 190 195

Net earnings $ 328 $ 336 $ 455 $ 364

Net earnings per basic share $ .65 $ .67 $ .91 $ .73

Net earnings per diluted share .64 .66 .90 .72

Quarterly amounts may not agree in total to the corresponding annual amounts due to rounding.

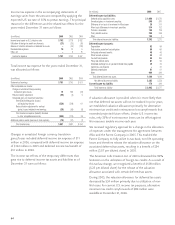

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is

defined in Exchange Act Rules 13a-15(f). Under the supervision and with the participation of our management, including our

principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of our internal control

over financial reporting based on the framework in Internal Control – Integrated Framework issued by the Committee of

Sponsoring Organizations of the Treadway Commission. Based on our evaluation under this framework, management has

concluded that our internal control over financial reporting was effective as of December 31, 2006.

KPMG LLP, an independent registered public accounting firm, has issued an audit report on management’s assessment of the

effectiveness of internal control over financial reporting as of December 31, 2006, as stated in their report, which is included herein.

Management’s Annual Report on Internal Control over Financial Reporting