Aflac 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As disclosed in our third quarter 2006 Form 10-Q, Aflac

Japan, along with the entire life insurance industry, began a

review of the last five years of paid claims to determine if

those claims were paid fully and accurately. In a recent

notification from the FSA, the review process has been

changed from a voluntary program to one that is mandatory

and has been expanded to include a review of cash surrender

value payments. Additionally, the FSA established a reporting

deadline of April 13, 2007. We expect to complete our review

of claims and cash surrender value payments and report our

findings to the FSA within the time frame specified. As a result

of this review, we have found some payment errors and we

are correcting them. Additionally, we are using this review to

identify process changes that will help ensure that payment

errors such as these are not repeated. Although immaterial

to our financial statements, we have recorded a liability for

our estimate of the underpaid portion of those claims in our

2006 financial statements.

AFLAC U.S. SEGMENT

Aflac U.S. Pretax Operating Earnings

Changes in Aflac U.S. pretax operating earnings and profit

margins are primarily affected by morbidity, mortality,

expenses, persistency and investment yields. The following

table presents a summary of operating results for Aflac U.S.

The percentage increases in premium income reflect the

growth of premiums in force. The increases in annualized

premiums in force of 10.5% in 2006, 10.0% in 2005, and

10.9% in 2004 were favorably affected by increased sales at

the worksite primarily through cafeteria plans and a slight

improvement in the persistency of several products.

Annualized premiums in force at December 31 were $4.1

billion in 2006, compared with $3.7 billion in 2005 and $3.4

billion in 2004.

The following table presents a summary of operating ratios for

Aflac U.S.

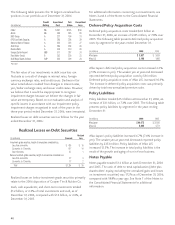

After several years of trending upward, the benefit ratio

declined modestly in 2006. As a percentage of premium

income, the benefit ratio was 61.0% in 2006, 61.3% in 2005,

and 61.4% in 2004. We expect the benefit ratio to decline

slightly in future periods due to favorable

claim cost trends. The 2006 operating

expense ratio reflects the write-off of

remaining deferred policy acquisition

costs associated with a large payroll

account that terminated in the first

quarter. We expect the operating expense

ratio, excluding discretionary promotional

expenses, to remain relatively stable in

future periods. The pretax operating

profit margin is expected to increase

slightly in 2007.

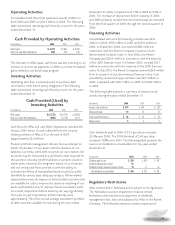

Aflac U.S. Sales

For 2006, total new annualized premium

sales increased 13.1%, which exceeded

our objective of 8% to 12% growth for

the year. These record sales results were

due, in part, to the re-enrollment of a

large payroll account. Our accident/

disability and cancer expense products

were again the primary contributors to

sales. The table on the top left of the following page presents

Aflac’s U.S. total new annualized premium sales for the years

ended December 31.

33

Aflac U.S. Summary of Operating Results

(In millions) 2006 2005

2004

Premium income $ 3,552 $ 3,245 $ 2,935

Net investment income 465 421 396

Other income 10 10 9

Total operating revenues 4,027 3,676 3,340

Benefits and claims 2,169 1,991 1,803

Operating expenses:

Amortization of deferred policy acquisition costs 290 258 245

Insurance commissions 444 410 371

Insurance and other expenses 539 492 424

Total operating expenses 1,273 1,160 1,040

Total benefits and expenses 3,442 3,151 2,843

Pretax operating earnings* $ 585 $ 525 $ 497

Percentage changes over previous year:

Premium income 9.5% 10.6% 13.1%

Net investment income 10.4 6.5 9.4

Total operating revenues 9.5 10.0 12.6

Pretax operating earnings* 11.4 5.6 11.7

*See Page 30 for our definition of segment operating earnings.

Ratios to total revenues: 2006 2005

2004

Benefits and claims 53.9% 54.2% 54.0%

Operating expenses:

Amortization of deferred policy acquisition costs 7.2 7.0 7.3

Insurance commissions 11.0 11.2 11.1

Insurance and other expenses 13.4 13.3 12.7

Total operating expenses 31.6 31.5 31.1

Pretax operating earnings* 14.5 14.3 14.9

*See Page 30 for our definition of segment operating earnings.