Aflac 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

The distributions of debt securities we own, by credit rating,

were as follows:

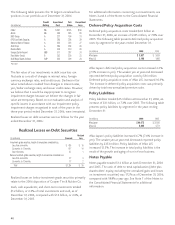

The overall credit quality of our portfolio remained high in

part because our investment policy prohibits us from

purchasing below-investment-grade securities. In the event of

a credit rating downgrade to below-investment-grade status,

we do not automatically liquidate our position. However, if the

security is in the held-to-maturity portfolio, we immediately

transfer it to the available-for-sale portfolio so that the

security’s fair value and its unrealized gain/loss are reflected

on the balance sheet.

Once we designate a security as below investment grade, we

intensify our monitoring of the issuer. We do

not automatically recognize an impairment if

the security’s amortized cost exceeds its fair

value. Our investment management starts by

reviewing its credit analysis. Included in this

process are an evaluation of the issuer, its

current credit posture and an assessment of

the future prospects for the issuer. We then

obtain fair value information from at least

three independent pricing sources. Upon

determining the fair value, we move our focus

to an analysis of whether or not the decline in fair value, if any,

is other than temporary. For securities with an amortized cost

in excess of fair value, investment management then reviews

the issue based on our impairment policy to determine if the

investment should be impaired and/or liquidated. The

assessment of whether a decline is other than temporary

requires significant management judgment and is discussed

more fully in the Critical Accounting Estimates section on Page

24. Securities classified as below investment grade as of

December 31 were as follows:

Occasionally a debt security will be split rated. This occurs

when one rating agency rates the security as investment grade

while another rating agency rates the same security as below

investment grade. Our policy is to review each issue on a case-

by-case basis to determine if a split-rated security should be

classified as investment grade or below investment grade. Our

review includes evaluating the issuer’s credit position as well as

current market pricing and other factors, such as the issuer’s

or security’s inclusion on a credit rating downgrade watch list.

Split-rated securities as of December 31, 2006, represented

.2% of total debt securities at amortized cost and were as

follows:

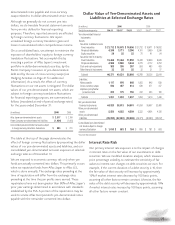

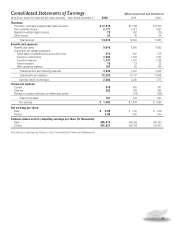

Composition of Purchases by

Credit Rating

2006 2005 2004

AAA 10.6% 6.1% 9.1%

AA 48.9 45.5 41.2

A35.1 42.9 36.7

BBB 5.4 5.5 13.0

Total 100.0% 100.0% 100.0%

Composition by Credit Rating

December 31, 2006 December 31, 2005

Amortized Fair Amortized Fair

Cost Value Cost Value

AAA 5.8% 5.7% 4.0% 3.9%

AA 35.0 35.8 33.7 34.9

A39.4 39.2 38.9 38.7

BBB 17.2 17.2 21.1 20.6

BB or lower 2.6 2.1 2.3 1.9

Total 100.0% 100.0% 100.0% 100.0%

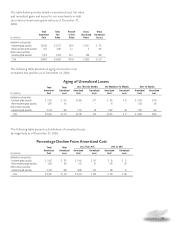

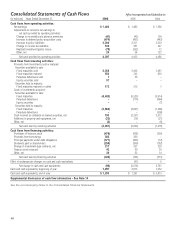

Below-Investment-Grade Securities

2006 2005

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Ahold $ 300 $ 245 $ 302 $ 236

KLM Royal Dutch Airlines 252 229 254 227

Ford Motor Credit 252 229 254 209

CSAV 201 145 **

Ford Motor Company 122 100 123 84

BAWAG 118 103 **

LeGrand ** 46 52

Cooper Tire & Rubber Co. ** ** 45 45

Tennessee Gas Pipeline 30 35 31 33

Total $ 1,275 $ 1,086 $ 1,055 $ 886

*Investment grade at respective reporting date

**Sold during 2006

Split-Rated Securities

Amortized Moody’s S&P Fitch Investment-Grade

(In millions)

Cost Rating Rating Rating Status

Tyco Electronics AMP (AMP Japan) $ 50 Ba1 BBB+ BBB+ Investment Grade

LeGrand 46 Baa3 BB+ BBB- Investment Grade

Union Carbide Corp. 15 Ba2 BBB- BBB Investment Grade