Aflac 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

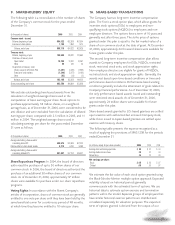

option model and represents the weighted-average period of

time that options granted are expected to be outstanding. We

base the risk-free interest rate on the Treasury note rate with a

term comparable to that of the estimated term of options.

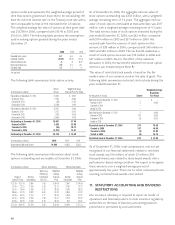

The weighted-average fair value of options at their grant date

was $15.28 for 2006, compared with $13.40 in 2005 and

$10.66 in 2004. The following table presents the assumptions

used in valuing options granted during the years ended

December 31.

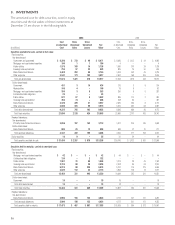

2006 2005 2004

Expected term (years) 6.7 6.6 4.9

Expected volatility 28.0% 28.0% 27.0%

Annual forfeiture rate .8 .8 N/A*

Risk-free interest rate 4.5 4.0 4.0

Dividend yield 1.1 1.1 .9

*Not applicable

The following table summarizes stock option activity.

Option Weighted-Average

(In thousands of shares) Shares Exercise Price Per Share

Outstanding at December 31, 2003 21,636 $ 20.87

Granted in 2004 2,793 39.80

Canceled in 2004 (58) 31.25

Exercised in 2004 (2,284) 14.84

Outstanding at December 31, 2004 22,087 23.86

Granted in 2005 2,107 41.01

Canceled in 2005 (230) 35.36

Exercised in 2005 (3,983) 14.50

Outstanding at December 31, 2005 19,981 27.40

Granted in 2006 2,456 45.08

Canceled in 2006 (90) 39.72

Exercised in 2006 (2,241) 18.61

Outstanding at December 31, 2006 20,106 $ 30.48

(In thousands of shares) 2006 2005 2004

Shares exercisable, end of year 16,094 14,603 15,833

The following table summarizes information about stock

options outstanding and exercisable at December 31, 2006.

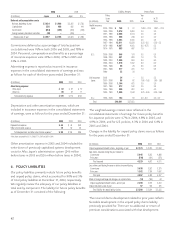

(In thousands of shares) Options Outstanding Options Exercisable

Wgtd.-Avg. Weighted- Weighted-

Remaining Average Average

Range of Number Contractual Exercise Number Exercise

Exercise Prices Outstanding Life (Yrs.) Price Exercisable Price

$ 12.38 – $21.16 2,990 1.65 $ 16.09 2,990 $ 16.09

21.48 – 23.23 3,780 3.26 23.12 3,780 23.12

23.41 – 29.66 3,245 4.23 26.54 3,245 26.54

29.68 – 31.75 2,882 6.05 31.22 2,865 31.22

32.09 – 40.03 2,134 7.77 38.24 1,008 37.72

40.30 – 43.38 2,535 7.88 41.21 1,702 40.42

43.66 – 49.15 2,540 9.19 45.35 504 43.67

$ 12.38 – $49.15 20,106 5.39 $ 30.48 16,094 $ 27.33

As of December 31, 2006, the aggregate intrinsic value of

stock options outstanding was $333 million, with a weighted-

average remaining term of 5.4 years. The aggregate intrinsic

value of stock options exercisable at that same date was $317

million, with a weighted-average remaining term of 4.5 years.

The total intrinsic value of stock options exercised during the

year ended December 31, 2006, was $62 million, compared

with $114 million in 2005 and $57 million in 2004. We

received cash from the exercise of stock options in the

amount of $38 million in 2006, compared with $49 million in

2005 and $32 million in 2004. The tax benefit realized as a

result of stock option exercises was $19 million in 2006 and

$37 million in 2005. Due to the effect of the valuation

allowance in 2004, the tax benefit realized from stock option

exercises was immaterial (see Note 8).

The value of restricted stock awards is based on the fair

market value of our common stock at the date of grant. The

following table summarizes restricted stock activity during the

years ended December 31.

Weighted-Average

Grant-Date

(In thousands of shares) Shares Fair Value

Restricted stock at December 31, 2003 – $ –

Granted in 2004 2 39.98

Canceled in 2004 – –

Vested in 2004 – –

Restricted stock at December 31, 2004 2 39.98

Granted in 2005 274 39.55

Canceled in 2005 (6) 38.75

Vested in 2005 – –

Restricted stock at December 31, 2005 270 39.58

Granted in 2006 357 46.96

Canceled in 2006 (8) 42.92

Vested in 2006 (6) 38.75

Restricted stock at December 31, 2006 613 $ 43.84

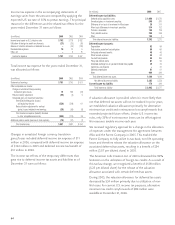

As of December 31, 2006, total compensation cost not yet

recognized in our financial statements related to restricted

stock awards was $16 million, of which $7 million (305

thousand shares) was related to share-based awards with a

performance-based vesting condition. We expect to recognize

these amounts over a weighted-average period of

approximately two years. There are no other contractual terms

covering restricted stock awards once vested.

11. STATUTORY ACCOUNTING AND DIVIDEND

RESTRICTIONS

Our insurance subsidiary is required to report its results of

operations and financial position to state insurance regulatory

authorities on the basis of statutory accounting practices

prescribed or permitted by such authorities.