Aflac 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

In June 2006, we began selling a new cancer plan aimed at

existing cancer insurance policyholders. This new product

provides additional benefits for inpatient and outpatient care.

Our cancer life policies are also marketed by Dai-ichi Mutual

Life and in June 2006, Dai-ichi Life began selling a new cancer

product customized for their market. As a result, new sales

from cancer insurance products were stable in 2006. We are

convinced that the affordable cancer products Aflac Japan

provides will continue to be an important part of our product

portfolio.

We continue to expect 2007 to be a challenging year from a

sales perspective and look for sales to again decline in the first

half of the year, followed by modest sales increases in the

second half of 2007.

Aflac Japan Investments

Growth of investment income in yen is affected by available

cash flow from operations, timing of and yields on new

investments, and the effect of yen/dollar exchange rates on

dollar-denominated investment income. Aflac Japan has

invested in privately issued securities to secure higher yields

than Japanese government or other public corporate bonds

would have provided, while still adhering to prudent standards

for credit quality. All of our privately issued securities are rated

investment grade at the time of purchase. These securities are

generally issued with standard documentation for medium-

term note programs and have appropriate covenants.

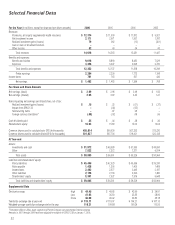

The following table presents the results of Aflac Japan’s

investment activities for the years ended December 31.

At December 31, 2006, the yield on Aflac Japan’s investment

portfolio, including dollar-denominated investments, was

4.14%, compared with 4.22% a year ago. See Investments and

Cash on Page 36 for additional information.

Japanese Economy

Recent events indicate that Japan’s economy has begun to

recover. The Bank of Japan’s January 2007 Monthly Report of

Recent Economic & Financial Developments stated that

Japan’s economy is expanding moderately, noting increases in

exports and capital expenditures and moderate increases in

household income, private consumption and housing

investment, all against the backdrop of high corporate profits

and expansion of overseas economies. The report did note a

downward trend related to public investment and projected

the trend to continue. However, it also included an

expectation that the economy would continue to expand

moderately, supported by expectations of increasing exports

and domestic private demand. Nevertheless, the time required

for a full economic recovery remains uncertain.

Japan’s system of compulsory public health care insurance

provides medical coverage to every Japanese citizen. These

public medical expenditures are covered by a combination of

premiums paid by insureds and their employers, taxes, and

copayments from the people who receive medical service.

However, given Japan’s aging population, the resources

available to these publicly funded social insurance programs

have come under increasing pressure. As a result, copayments

and other out-of-pocket expenses have been rising and

affecting more people. In 2003, copayments were raised from

20% to 30% for most consumers and other reforms were

implemented in 2006. Additional reforms are being

considered. We believe higher out-of-pocket expenses will

lead more consumers to purchase supplemental insurance

plans. Many insurance companies have recognized the

opportunities for selling supplemental medical insurance in

Japan and have launched new products in recent years.

However, we believe our favorable cost structure compared

with other insurers makes us a very effective competitor. In

addition, we believe our brand, customer service, and financial

strength also benefit our market position.

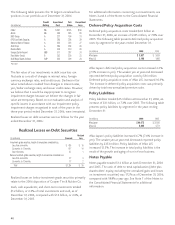

Japanese Regulatory Environment

The FSA adopted new mortality tables effective April 1, 2007,

that will be used when developing our policy premium and

reserving assumptions on newly underwritten policies. These

new tables reflect recent improvements in survival rates in

Japan. If our other assumptions remain unchanged, these

revisions will generally lead to a decrease in policy premiums

for death benefit products and an increase in premium rates

for third sector products and annuities.

Additionally, the FSA has implemented a new rule for third

sector product reserving. The new reserving rule will be

implemented in the Japanese fiscal year starting April 1, 2007.

Under the new rule, we are required to conduct stress testing

of our reserves using a prescribed method that incorporates

actual incidence rates. The results of the tests and their

relation to our reserves determine whether reserve

strengthening is required. We do not anticipate that the new

reserving requirements will have a material impact on our

FSA-based financial statements or our pricing.

2006 2005 2004

New money yield - yen only 3.10% 2.95% 2.94%

New money yield - blended 3.33 3.19 3.13

Return on average invested assets,

net of investment expenses 4.11 4.14 4.26