Aflac 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

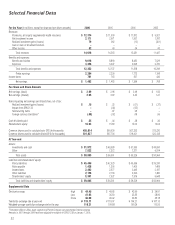

• Investments and cash increased 5.9% to $43.8

billion at the end of 2006. In yen, investments

and cash were up 6.8%.

• Net investment income increased 3.2% to $1.7

billion. In yen, net investment income rose 9.0%.

• The average yield on new investments was

3.33% in 2006, compared with 3.19% in

2005.

Aflac Japan’s overall credit quality remained

high. At the end of 2006, 80.7% of our

holdings were rated A or better on an

amortized cost basis. Only 2.7% of our debt

securities were rated below investment

grade at the end of 2006. We believe that

our conservative investment approach serves

our customers and shareholders very well.

Laying the Groundwork

for Future Growth

As we formulate our plans for the future, we

believe the competitive strengths that have

resulted in our market leadership will

continue to serve us well. And while the

demand for our medical products was weak

in 2006, we are still convinced of the basic

need for our products. We believe this need

will continue as consumers face the prospect

of higher out-of-pocket expenses for

medical care. To help us further penetrate

the Japanese market, we will:

• Enhance our product line – We will research

and develop innovative policies and update

existing products to adapt to the evolving needs

of Japanese consumers with benefits that help

them cope with the increasing burden of out-of-

pocket health care costs.

• Promote our brand position – We will

emphasize our market leading status to attract

consumers and distinguish our products in a

more competitive market.

• Enhance our distribution system – We will

recruit more sales agencies to reach additional

consumers, while also providing them with

better sales tools through new training

programs.

• Improve operational efficiency – We will invest

in new technologies and streamline our business

processes to increase our core competitive

advantage and provide convenience for

policyholders and consumers.

15