Aflac 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

adjustment to accumulated other comprehensive income, net

of tax. The adjustment to accumulated other comprehensive

income at adoption represents the net unrecognized actuarial

losses, unrecognized prior service costs or credits, as

applicable, and the unrecognized transition asset remaining

from the initial adoption of SFAS 87, all of which were

previously netted against the plan’s funded status in the past

under the provisions of SFAS 87. These amounts will be

subsequently recognized as net periodic pension cost over

future periods consistent with our historical accounting policy

for amortizing such amounts. Further, the components of the

benefit obligations that arise in subsequent periods and are

not recognized as net periodic pension cost in the same

periods will be recognized as a component of other

comprehensive income. Those amounts will also be

subsequently recognized as a component of net periodic

pension cost as previously described. The adoption of SFAS

158 had no effect on our earnings for the year ended

December 31, 2006, or for any prior period presented, and it

will not affect our operating results in future periods.

The incremental effects of adopting the provisions of SFAS

158 on our consolidated balance sheets, statements of

shareholders’ equity and statements of comprehensive income

at December 31, 2006, are presented in the following table.

Had we not adopted SFAS 158 at December 31, 2006, we

would have recognized an additional minimum liability under

the provisions of SFAS 87. The effect of recognizing the

additional minimum liability is included in the table below in

the column labeled “Prior to Application of SFAS 158.”

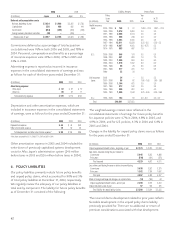

Prior to Effect of As Reported

Application SFAS 158 December 31,

(In millions) of SFAS 158 Pension Plans Other 2006

Income taxes $ 2,488 $ (20) $ (6) $ 2,462

Other liabilities 1,257 56 16 1,329

Total liabilities 51,418 36 10 51,464

Retained earnings 9,306 (2) – 9,304

Pension liability adjustment 34 34 10 78

Accumulated other

comprehensive income 1,382 34 10 1,426

Total shareholders’ equity 8,387 (36) (10) 8,341

We recognized a charge to opening retained earnings of $2

million net of tax and a reduction of accumulated other

comprehensive income of $4 million, net of tax related to the

adoption of the measurement date provisions of SFAS 158 for

our U.S. pension plan. The Japanese pension plan previously

used a measurement date of December 31. The impact of

adopting the measurement date provisions of SFAS 158 for

our other post employment benefit plans was negligible.

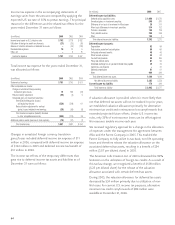

The following table summarizes the amounts included

in accumulated other comprehensive income as of

December 31, 2006.

(In millions) Japan U.S. Other

Actuarial loss $ 35 $ 62 $ 16

Prior service cost (credit) (4) 1 –

Transition obligation 2 – –

Total $ 33 $ 63 $ 16

An actuarial gain of $1 million related to the Japanese plan

arose during the year and was included in accumulated other

comprehensive income; an actuarial loss of $4 million related

to the U.S. plan arose during the year and was included in

accumulated other comprehensive income. During 2006,

$2 million of actuarial loss was amortized to expense for the

Japanese plan, while $3 million was amortized to expense for

the U.S. plan.

No prior service costs or credits arose during 2006 and the

amounts of prior service costs and credits amortized to

expense were immaterial for the year ended December 31,

2006. Amortization of actuarial losses to expense in 2007 is

estimated to be $2 million for the Japanese plan and $4

million for the U.S. plan, while the amortization of prior

service cost and credit is expected to be negligible.

Reconciliations of the funded status of the basic employee

defined-benefit pension plans with amounts recognized in the

consolidated balance sheets as of December 31 were as follows:

2006 2005

(In millions) Japan U.S. Japan U.S.

Projected benefit obligation:

Benefit obligation, beginning of year $ 104 $ 162 $ 112 $ 131

Adoption of SFAS 158 –3––

Service cost 8997

Interest cost 3938

Plan amendment ––(5) –

Actuarial loss (gain) (1) 4 118

Benefits paid (3) (3) (2) (2)

Effect of foreign exchange rate changes (1) – (14) –

Benefit obligation, end of year 110 184 104 162

Plan assets:

Fair value of plan assets, beginning of year 47 95 39 70

Adoption of SFAS 158 –2––

Actual return on plan assets 312 57

Employer contribution 20 20 10 20

Benefits paid (3) (3) (2) (2)

Effect of foreign exchange rate changes (1) – (5) –

Fair value of plan assets, end of year 66 126 47 95

Funded status (44) (58) (57) (67)

Unrecognized net actuarial loss (gain) ––40 68

Unrecognized transition obligation (asset) ––2–

Unrecognized prior service cost ––(4) 2

Adjustment for minimum pension liability ––(21) (28)

Liability for accrued benefit cost $ (44) $ (58) $ (40) $ (25)

Accumulated benefit obligation $ 93 $ 137 $ 87 $ 120