Aflac 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

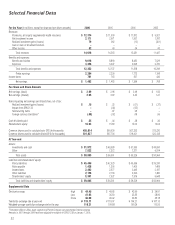

earnings growth. Some investing highlights

from 2006 include:

• Investments and cash were $7.5 billion at the

end of 2006, up 6.3% from 2005.

• Net investment income rose 10.4%, from $421

million in 2005 to $465 million in 2006.

• The average yield on new investments was

6.44% in 2006, compared with 6.16% the

previous year.

Corporate debt securities again accounted

for the majority of our U.S. investments in

2006. Based on amortized cost, 76.3% of

our holdings were rated A or better at the

end of 2006, and only 2.1% were rated

below investment grade.

Outlook for Aflac U.S. –

The Future is Bright

As we look ahead in the U.S. market, we

believe the need for the types of products

Aflac offers is growing. Aflac’s policies have

valuable and affordable benefits that provide

timely help for our policyholders when they

need it most. And we have a large sales force

that specializes in distributing products

through the worksite. Our more than

372,000 payroll accounts represent just 6%

of the 5.7 million small businesses in the

United States, which suggests there is a vast,

untapped market of potential payroll

accounts and customers. We believe Aflac is

well-positioned to capitalize on those

opportunities. To accomplish that, we will:

• Build on our product line – We will concentrate

on identifying consumers’ needs and create

innovative and affordable products that address

those needs.

• Enhance our distribution system – Continued

expansion, training, support and leadership is

essential to reaching more consumers and

producing sustainable sales momentum.

• Strengthen connections using the Aflac

brand – Brand awareness and definition will

remain a high priority for showing how Aflac

can come to the rescue of employers and their

employees.

• Improve efficiency through technology –

We will continue to upgrade our technology

to improve the services we offer our customers

and sales associates while at the same time

controlling operating expenses.

21