Aflac 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

approval for dividend distributions that exceed the greater of

the net gain from operations, which excludes net realized

investment gains, for the previous year determined under

statutory accounting principles, or 10% of statutory capital

and surplus as of the previous year-end. In addition, the

Nebraska insurance department must approve service

arrangements and other transactions within the affiliated

group of companies. These regulatory limitations are not

expected to affect the level of management fees or dividends

paid by Aflac to the Parent Company. A life insurance

company’s statutory capital and surplus is determined

according to rules prescribed by the NAIC, as modified by the

insurance department in the insurance company’s state of

domicile. Statutory accounting rules are different from GAAP

and are intended to emphasize policyholder protection and

company solvency.

The continued long-term growth of our business may require

increases in the statutory capital and surplus of our insurance

operations. Aflac’s insurance operations may secure additional

statutory capital through various sources, such as internally

generated statutory earnings or equity contributions by the

Parent Company from funds generated through debt or equity

offerings. The NAIC’s risk-based capital (RBC) formula is used

by insurance regulators to facilitate identification of

inadequately capitalized insurance companies. The RBC

formula quantifies insurance risk, business risk, asset risk and

interest rate risk by weighing the types and mixtures of risks

inherent in the insurer’s operations. Aflac’s RBC ratio remains

high and reflects a very strong capital and surplus position.

Currently, the NAIC has ongoing regulatory initiatives relating

to revisions to the RBC formula as well as numerous initiatives

covering insurance products, investments, and other actuarial

and accounting matters. We believe that we will continue to

maintain a strong RBC ratio and statutory capital and surplus

position in future periods.

In addition to limitations and restrictions imposed by U.S.

insurance regulators, Japan’s FSA may not allow profit

repatriations or other transfers from Aflac Japan if they would

cause Aflac Japan to lack sufficient financial strength for the

protection of policyholders. The FSA maintains its own

solvency standard. Aflac Japan’s solvency margin ratio

significantly exceeds regulatory minimums.

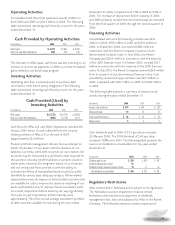

Payments are made from Aflac Japan to the Parent Company

for management fees and to Aflac U.S. for allocated expenses

and profit repatriations. During 2006, Aflac Japan paid $25

million to the Parent Company for management fees,

compared with $28 million in 2005 and $24 million in 2004.

Expenses allocated to Aflac Japan were $32 million in 2006,

$30 million in 2005 and $26 million in 2004. During 2006,

Aflac Japan repatriated profits of $442 million (¥50.0 billion)

to Aflac U.S., compared with $374 million (¥41.2 billion) in

2005 and $220 million (¥23.9 billion) in 2004. Profits

repatriated in 2004 were lower primarily as a result of realized

investment losses recognized in 2003. For additional

information on regulatory restrictions on dividends, profit

repatriations and other transfers, see Note 11 of the Notes to

the Consolidated Financial Statements.

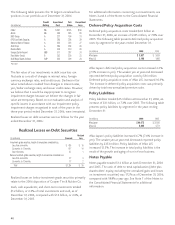

Rating Agencies

Aflac is rated AA by both Standard & Poor’s and Fitch Ratings

and Aa2 (Excellent) by Moody’s for financial strength. A.M.

Best assigned Aflac an A+ (Superior) rating for financial

strength and operating performance. Aflac Incorporated’s

senior debt, Samurai notes, and Uridashi notes are rated A by

Standard & Poor’s, A+ by Fitch Ratings, and A2 by Moody’s.

Other

In October 2006, the board of directors declared the first

quarter 2007 cash dividend of $.185 per share. The dividend is

payable on March 1, 2007, to shareholders of record at the

close of business on February 16, 2007. In 2004, the board of

directors authorized the purchase of up to 30 million shares of

our common stock. In 2006, the board of directors authorized

the purchase of an additional 30 million shares of our

common stock. As of December 31, 2006, approximately 37

million shares were available for purchase under our share

repurchase programs.

For information regarding commitments and contingent

liabilities, see Note 13 of the Notes to the Consolidated

Financial Statements.