Aflac 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

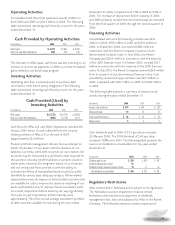

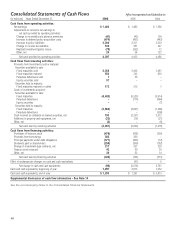

Operating Activities

Consolidated cash flow from operations was $4.4 billion in

both 2006 and 2005, and $4.5 billion in 2004. The following

table summarizes operating cash flows by source for the years

ended December 31.

The decrease in Aflac Japan cash flows was due primarily to an

increase in income tax payments in 2006 as a result of realized

gains related to our bond-swap program.

Investing Activities

Operating cash flow is primarily used to purchase debt

securities to meet future policy obligations. The following

table summarizes investing cash flows by source for the years

ended December 31.

Cash flows for Aflac U.S. and Other Operations included the

January 2005 return of cash collateral from the security

lending activities of Aflac U.S. at the end of 2004

(approximately $2.6 billion).

Prudent portfolio management dictates that we attempt to

match the duration of our assets with the duration of our

liabilities. Currently, when debt securities we own mature, the

proceeds may be reinvested at a yield below that required for

the accretion of policy benefit liabilities on policies issued in

earlier years. However, the long-term nature of our business

and our strong cash flows provide us with the ability to

minimize the effect of mismatched durations and/or yields

identified by various asset adequacy analyses. When market

opportunities arise, we dispose of selected debt securities that

are available for sale to improve the duration matching of our

assets and liabilities and/or improve future investment yields.

As a result, dispositions before maturity can vary significantly

from year to year. Dispositions before maturity were

approximately 7% of the annual average investment portfolio

of debt securities available for sale during the year ended

December 31, 2006, compared with 11% in 2005 and 5% in

2004. The increase of dispositions before maturity in 2006

and 2005 primarily resulted from the bond swaps we executed

from the third quarter of 2005 through the second quarter of

2006.

Financing Activities

Consolidated cash used by financing activities was $434

million in 2006, $196 million in 2005 and $313 million in

2004. In September 2006, we received $382 million in

connection with the Parent Company’s issuance of yen-

denominated Uridashi notes. In June 2006, the Parent

Company paid $355 million in connection with the maturity

of the 2001 Samurai notes. In October 2005, we paid $261

million in connection with the maturity of the 2000 Samurai

notes. In July 2005, the Parent Company received $360 million

from its issuance of yen-denominated Samurai notes. Cash

provided by investment-type contracts was $217 million in

2006, compared with $257 million in 2005 and $220 million

in 2004.

The following table presents a summary of treasury stock

activity during the years ended December 31.

Cash dividends paid in 2006 of $.55 per share increased

25.0% over 2005. The 2005 dividend of $.44 per share

increased 15.8% over 2004. The following table presents the

sources of dividends to shareholders for the years ended

December 31.

Regulatory Restrictions

Aflac is domiciled in Nebraska and is subject to its regulations.

The Nebraska insurance department imposes certain

limitations and restrictions on payments of dividends,

management fees, loans and advances by Aflac to the Parent

Company. The Nebraska insurance statutes require prior

Cash Provided by Operating Activities

(In millions)

2006 2005

2004

Aflac Japan $ 3,437 $ 3,691 $ 3,670

Aflac U.S. and Other Operations 960 742 816

Cash Provided (Used) by

Investing Activities

(In millions)

2006 2005

2004

Aflac Japan $ (3,372) $ (3,574) $ (3,692)

Aflac U.S. and Other Operations (685) (3,118) 2,274

(In millions) 2006 2005

2004

Treasury stock purchases $ 470 $ 438 $ 392

Shares purchased 10 10 10

Stock issued from treasury $42 $50 $39

Shares issued 343

(In millions) 2006 2005

2004

Dividends paid in cash $ 258 $ 209 $ 182

Dividends declared but not paid 91 ––

Dividends through issuance of treasury shares 15 11 10

Total dividends to shareholders $ 364 $ 220 $ 192