Aflac 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

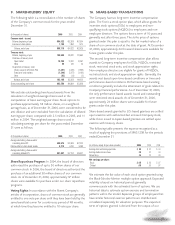

Peer Company

Comparison

Aflac’s total return to

shareholders compounded

at 16.7% annually over

the last 10 years.

Glossary

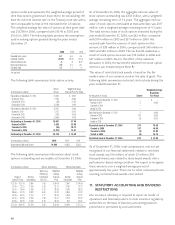

Affiliated Corporate Agency – An

agency that is directly affiliated with a

specific corporation. A corporation

establishes the agency to sell our

insurance policies to its employees on

payroll deduction. In turn, we pay the

agency a commission.

Benefit Ratio – Incurred claims plus the

increase in reserves for future policy

benefits, as a percentage of total revenues.

Deferred Policy Acquisition

Costs (DAC) – The costs of acquiring

new business, principally agents’ current-

year commissions in excess of ultimate

renewal-year commissions, and certain

policy issue, underwriting and marketing

expenses, have been capitalized and

deferred. These deferred policy

acquisition costs are amortized over the

premium paying period in proportion to

anticipated premium income of the

related policies.

Earnings Per Basic Share – Net earnings

divided by the weighted-average number

of shares outstanding for the period.

Earnings Per Diluted Share – Net

earnings divided by the weighted-average

number of shares outstanding for the

period plus the weighted-average shares

for the dilutive effect of share-based

awards outstanding.

Future Policy Benefits – A liability

established to provide for claims that will

occur in the future. This is the largest

liability on the balance sheet.

Incurred Claims – The amount of claims

paid plus the change in unpaid policy

claims liability.

Persistency – The percentage of

premiums remaining in force at the end of

a period, usually one year. Example: 95%

persistency would mean that 95% of the

premiums in force at the beginning of the

period were still in force at the end of the

period.

Profit Repatriation – Profits of Aflac

Japan that are transferred to Aflac U.S.

Return on Average Invested Assets –

Net investment income as a percentage

of cash and average investments at

amortized cost.

Total New Annualized Premium

Sales – The annual premiums on policies

sold and incremental annual premiums on

policies converted during the reporting

period.

Total Return to Shareholders –

The appreciation of a shareholder’s

investment over a period of time,

including reinvested cash dividends paid

during that time.

75

Year-end Five-Year 10-Year

Market Value 2006 Annual Annual

Symbol (In billions) Return* Return* Return*

Aflac AFL $ 22.7 .3% 14.5% 16.7%

Lincoln National LNC 18.4 28.4 9.9 13.0

MetLife MET 44.9 21.6 14.3 **

Principal Financial PFG 15.8 25.4 21.1 **

Prudential Financial PRU 41.1 18.6 22.3 **

Torchmark TMK 6.3 15.6 11.1 12.5

Unum Group UNM 7.1 (7.3) (2.7) (3.5)

*Includes reinvested cash dividends **Not applicable