Aflac 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

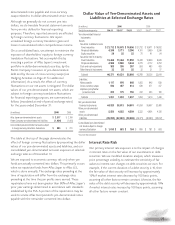

Foreign Currency Translation

Aflac Japan’s premiums and most of its investment income are

received in yen. Claims and expenses are paid in yen, and we

primarily purchase yen-denominated assets to support yen-

denominated policy liabilities. These and other yen-

denominated financial statement items are translated into

dollars for financial reporting purposes. We translate Aflac

Japan’s yen-denominated income statement into dollars using

an average exchange rate for the reporting period, and we

translate its yen-denominated balance sheet using the

exchange rate at the end of the period. However, it is

important to distinguish between translating and converting

foreign currency. Except for a limited number of transactions,

we do not actually convert yen into dollars.

Due to the size of Aflac Japan, where our functional currency

is the Japanese yen, fluctuations in the yen/dollar exchange

rate can have a significant effect on our reported results. In

periods when the yen weakens, translating yen into dollars

results in fewer dollars being reported. When the yen

strengthens, translating yen into dollars results in more dollars

being reported. Consequently, yen weakening has the effect of

suppressing current year results in relation to the prior year,

while yen strengthening has the effect of magnifying current

year results in relation to the prior year. As a result, we view

foreign currency translation as a financial reporting issue for

Aflac and not an economic event to our Company or

shareholders. Because changes in exchange rates distort the

growth rates of our operations, management evaluates Aflac’s

financial performance excluding the impact of foreign

currency translation.

Income Taxes

Our combined U.S. and Japanese effective income tax rate on

pretax earnings was 34.5% in 2006, 33.4% in 2005, and

28.6% in 2004. Total income taxes were $781 million in 2006,

compared with $743 million in 2005 and $507 million in 2004.

Japanese income taxes on Aflac Japan’s results account for

most of our consolidated income tax expense. Our 2005

income tax rate was lower than normal primarily as a result of

the release of the valuation allowance for non-life losses

discussed previously. Our 2004 income tax rate and tax

expense were also lower than normal as a result of the release

of the valuation allowance for deferred tax assets discussed

previously. See Note 8 of the Notes to the Consolidated

Financial Statements for additional information.

Earnings Guidance

We communicate earnings guidance in this report based on

the growth in net earnings per diluted share. However, certain

items that cannot be predicted or that are outside of

management’s control may have a significant impact on actual

results. Therefore, our comparison of net earnings includes

certain assumptions to reflect the limitations that are inherent

in projections of net earnings. In comparing year-over-year

results, we exclude the effect of realized investment gains and

losses, the impact from SFAS 133 and nonrecurring items. We

also assume no impact from foreign currency translation on

the Aflac Japan segment and the Parent Company’s yen-

denominated interest expense for a given year in relation to

the prior year.

Subject to the preceding assumptions, our objective for 2006

was to achieve net earnings per diluted share of at least $2.92,

an increase of 15.0% over 2005 using the preceding

assumptions. We reported 2006 net earnings per diluted share

of $2.95. Adjusting that number for realized investment gains

($.10 per diluted share), the impact from SFAS 133 (nil per

diluted share) and foreign currency translation (a loss of $.08

per diluted share), we exceeded our objective for the year.

Our objective for 2007 is to increase net earnings per diluted

share by 15% to 16% over 2006, on the basis described

above. If we achieve this objective, the following table shows

the likely results for 2007 net earnings per diluted share,

including the impact of foreign currency translation using

various yen/dollar exchange rate scenarios.

2007 Net Earnings Per Share (EPS) Scenarios*

Weighted-Average Net Earnings

Yen/Dollar Per % Growth Yen Impact

Exchange Rate Diluted Share Over 2006 on EPS

105.00 $ 3.45 - 3.48 21.1 - 22.1% $ .17

110.00 3.37 - 3.40 18.2 - 19.3 .09

116.31** 3.28 - 3.31 15.1 - 16.1 –

120.00 3.23 - 3.26 13.3 - 14.4 (.05)

125.00 3.17 - 3.20 11.2 - 12.3 (.11)

*Excludes realized investment gains/losses, impact from SFAS 133 and nonrecurring items in 2007 and 2006

**Actual 2006 weighted-average exchange rate