Aflac 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

INSURANCE OPERATIONS

Aflac’s insurance business consists of two

segments: Aflac Japan and Aflac U.S. Aflac

Japan, which operates as a branch of

Aflac, is the principal contributor to

consolidated earnings. GAAP financial

reporting requires that a company report

financial and descriptive information

about operating segments in its annual

financial statements. Furthermore, we are

required to report a measure of segment

profit or loss, certain revenue and expense

items, and segment assets.

We measure and evaluate our insurance

segments’ financial performance using

operating earnings on a pretax basis. We

define segment operating earnings as the

profits we derive from our operations

before realized investment gains and

losses, the impact from SFAS 133, and

nonrecurring items. We believe that an

analysis of segment pretax operating

earnings is vitally important to an

understanding of the underlying

profitability drivers and trends of our

insurance business. Furthermore, because

a significant portion of our business is conducted in Japan, we

believe it is equally important to understand the impact of

translating Japanese yen into U.S. dollars.

We evaluate our sales efforts using new annualized premium

sales, an industry operating measure. Total new annualized

premium sales, which include new sales and the incremental

increase in premiums due to conversions, represent the

premiums that we would collect over a 12-month period,

assuming the policies remain in force. Premium income, or

earned premiums, is a financial performance measure that

reflects collected or due premiums that have been earned

ratably on policies in force during the reporting period.

AFLAC JAPAN SEGMENT

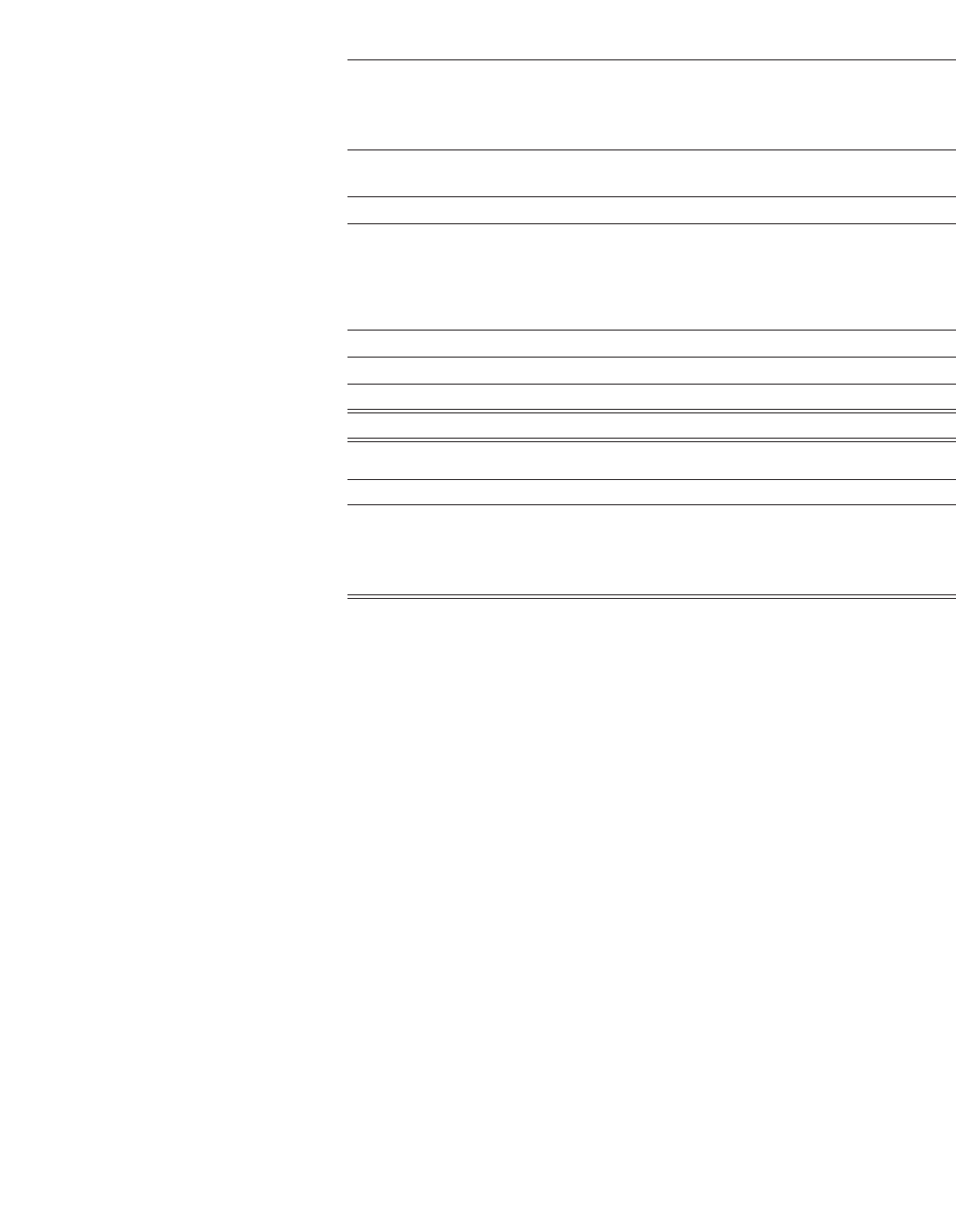

Aflac Japan Pretax Operating Earnings

Changes in Aflac Japan’s pretax operating earnings and profit

margins are primarily affected by morbidity, mortality,

expenses, persistency, and investment yields. The table above

presents a summary of operating results for Aflac Japan.

The percentage increases in premium income reflect the

growth of premiums in force. The increases in annualized

premiums in force in yen of 5.4% in 2006 and 6.8% in both

2005 and 2004, reflect the high persistency of Aflac Japan’s

business and the sales of new policies. Annualized premiums

in force at December 31, 2006, were ¥1.08 trillion, compared

with ¥1.03 trillion in 2005 and ¥961.9 billion in 2004.

Annualized premiums in force, translated into dollars at

respective year-end exchange rates, were $9.1 billion in 2006,

$8.7 billion in 2005 and $9.2 billion in 2004.

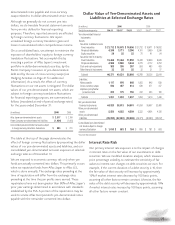

Aflac Japan maintains a portfolio of dollar-denominated and

reverse-dual currency securities (yen-denominated debt

securities with dollar coupon payments). Dollar-denominated

investment income from these assets accounted for

approximately 37% of Aflac Japan’s investment income in

2006, compared with 32% in 2005 and 30% in 2004. In years

when the yen strengthens in relation to the dollar, translating

Aflac Japan’s dollar-denominated investment income into yen

lowers growth rates for net investment income, total

operating revenues, and pretax operating earnings in yen

terms. In years when the yen weakens, translating dollar-

denominated investment income into yen magnifies growth

rates for net investment income, total operating revenues, and

pretax operating earnings in yen terms. On a constant

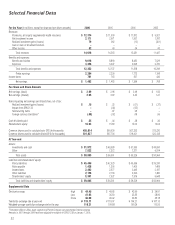

Aflac Japan Summary of Operating Results

(In millions) 2006 2005 2004

Premium income $ 8,762 $ 8,745 $ 8,368

Net investment income:

Yen-denominated investment income 1,064 1,111 1,087

Dollar-denominated investment income 624 524 470

Net investment income 1,688 1,635 1,557

Other income 25 31 18

Total operating revenues 10,475 10,411 9,943

Benefits and claims 6,847 6,898 6,679

Operating expenses:

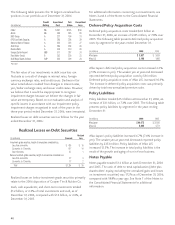

Amortization of deferred policy acquisition costs 285 284 274

Insurance commissions 859 892 881

Insurance and other expenses 832 822 730

Total operating expenses 1,976 1,998 1,885

Total benefits and expenses 8,823 8,896 8,564

Pretax operating earnings* $ 1,652 $ 1,515 $ 1,379

Weighted-average yen/dollar exchange rate 116.31 109.88 108.26

In Dollars In Yen

Percentage changes over previous year: 2006 2005 2004 2006 2005 2004

Premium income .2% 4.5% 14.2% 5.9% 6.3% 6.7%

Net investment income 3.2 5.0 9.6 9.0 7.0 2.3

Total operating revenues .6 4.7 13.4 6.3 6.6 6.0

Pretax operating earnings* 9.1 9.9 22.9 15.4 11.5 14.7

*See definition of segment operating earnings to left.