Aflac 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

9. SHAREHOLDERS’ EQUITY

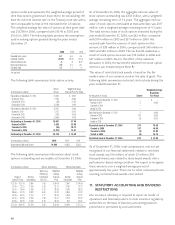

The following table is a reconciliation of the number of shares

of the Company’s common stock for the years ended

December 31.

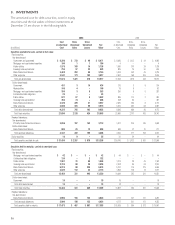

(In thousands of shares) 2006 2005 2004

Common stock - issued:

Balance, beginning of year 654,522 652,628 651,554

Exercise of stock options 1,193 1,894 1,074

Balance, end of year 655,715 654,522 652,628

Treasury stock:

Balance, beginning of year 155,628 149,020 141,662

Purchases of treasury stock:

Open market 10,265 10,000 10,061

Other 55 245 44

Dispositions of treasury stock:

Shares issued to AFL Stock Plan (1,461) (1,476) (1,585)

Exercise of stock options (1,240) (2,127) (1,160)

Other (82) (34) (2)

Balance, end of year 163,165 155,628 149,020

Shares outstanding, end of year 492,550 498,894 503,608

We exclude outstanding share-based awards from the

calculation of weighted-average shares used in the

computation of basic earnings per share. Stock options to

purchase approximately 1.8 million shares, on a weighted-

average basis, as of December 31, 2006, were considered to be

anti-dilutive and were excluded from the calculation of diluted

earnings per share, compared with 2.5 million in 2005, and 1.1

million in 2004. The weighted-average shares used in

calculating earnings per share for the years ended December

31 were as follows:

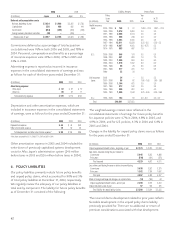

(In thousands of shares) 2006 2005 2004

Average outstanding shares used for

calculating basic EPS 495,614 500,939 507,333

Dilutive effect of share-based awards 6,213 6,765 9,088

Average outstanding shares used for

calculating diluted EPS 501,827 507,704 516,421

Share Repurchase Program: In 2004, the board of directors

authorized the purchase of up to 30 million shares of our

common stock. In 2006, the board of directors authorized the

purchase of an additional 30 million shares of our common

stock. As of December 31, 2006, approximately 37 million

shares were available for purchase under our share repurchase

programs.

Voting Rights: In accordance with the Parent Company’s

articles of incorporation, shares of common stock are generally

entitled to one vote per share until they have been held by the

same beneficial owner for a continuous period of 48 months,

at which time they become entitled to 10 votes per share.

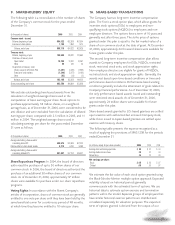

10. SHARE-BASED TRANSACTIONS

The Company has two long-term incentive compensation

plans. The first is a stock option plan, which allows grants for

incentive stock options (ISOs) to employees and non-

qualifying stock options (NQSOs) to employees and non-

employee directors. The options have a term of 10 years and

generally vest after three years. The strike price of options

granted under this plan is equal to the fair market value of a

share of our common stock at the date of grant. At December

31, 2006, approximately 26 thousand shares were available for

future grants under this plan.

The second long-term incentive compensation plan allows

awards to Company employees for ISOs, NQSOs, restricted

stock, restricted stock units, and stock appreciation rights.

Non-employee directors are eligible for grants of NQSOs,

restricted stock, and stock appreciation rights. Generally, the

awards vest based upon time-based conditions or time-and-

performance-based conditions. Performance-based vesting

conditions generally include the attainment of goals related to

Company financial performance. As of December 31, 2006,

the only performance-based awards issued and outstanding

were restricted stock awards. As of December 31, 2006,

approximately 24 million shares were available for future

grants under this plan.

Share-based awards granted to U.S.-based grantees are settled

upon exercise with authorized but unissued Company stock,

while those issued to Japan-based grantees are settled upon

exercise with treasury shares.

The following table presents the expense recognized as a

result of applying the provisions of SFAS 123R for the periods

ended December 31.

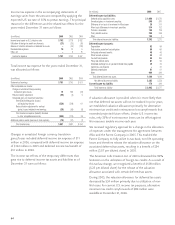

(In millions, except for per-share amounts) 2006 2005 2004

Earnings from continuing operations $35 $32 $34

Earnings before income taxes 35 32 34

Net earnings 25 23 33

Net earnings per share:

Basic $ .05 $ .05 $ .07

Diluted .05 .05 .07

We estimate the fair value of each stock option granted using

the Black-Scholes-Merton multiple option approach. Expected

volatility is based on historical periods generally

commensurate with the estimated term of options. We use

historical data to estimate option exercise and termination

patterns within the model. Separate groups of employees that

have similar historical exercise patterns are stratified and

considered separately for valuation purposes. The expected

term of options granted is derived from the output of our