Aflac 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

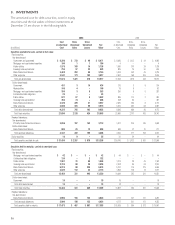

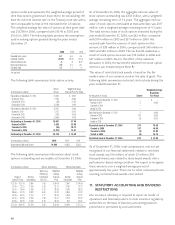

Aflac Japan Aflac U.S.

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Available for sale:

Due in one year or less $ 108 $ 109 $ 57 $ 58

Due after one year through five years 296 316 15 17

Due after five years through 10 years 294 393 35 35

Due after 10 years through 15 years 257 235 – –

Due after 15 years 2,918 2,882 361 363

Total perpetual debentures

available for sale $ 3,873 $ 3,935 $ 468 $ 473

Held to maturity:

Due after one year through five years $ 727 $ 751 $ – $ –

Due after five years through 10 years 1,600 1,682 – –

Due after 10 years through 15 years 86 88 – –

Due after 15 years 1,577 1,503 – –

Total perpetual debentures

held to maturity $ 3,990 $ 4,024 $ – $ –

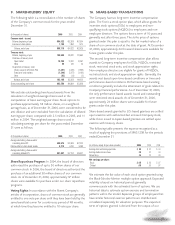

As part of our investment activities, we own investments in

qualified special purpose entities (QSPEs). At December 31,

2006, available-for-sale QSPEs totaled $2.3 billion at fair value

($2.3 billion at amortized cost, or 4.7% of total debt

securities), compared with $2.2 billion at fair value ($2.3 billion

at amortized cost, or 5.0% of total debt securities) at

December 31, 2005. We have no equity interests in any of the

QSPEs, nor do we have control over these entities. Therefore,

our loss exposure is limited to the cost of our investment.

We also own yen-denominated investments in variable interest

entities (VIEs) totaling $1.9 billion at fair value, ($2.0 billion at

amortized cost, or 4.2% of total debt securities) at December

31, 2006. We are the primary beneficiary of VIEs totaling $1.5

billion at fair value ($1.7 billion at amortized cost) and have

consolidated our interests in these VIEs in accordance with

FASB Interpretation No. 46 (revised December 2003),

Consolidation of Variable Interest Entities. The activities of

these VIEs are limited to holding debt securities and utilizing

the cash flows from the debt securities to service our

investments therein. The terms of the debt securities mirror

the terms of the notes held by Aflac. The consolidation of

these investments does not impact our financial position or

results of operations. We also have interests in VIEs that we are

not required to consolidate totaling $375 million at fair value

($373 million at amortized cost) as of December 31, 2006. The

loss on any of our VIE investments would be limited to its cost.

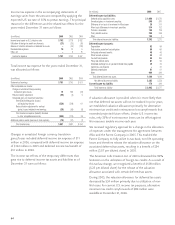

We lend fixed-maturity securities to financial institutions in

short-term security lending transactions. These short-term

security lending arrangements increase investment income

with minimal risk. Our security lending policy requires that the

fair value of the securities and/or cash received as collateral

be 102% or more of the fair value of the loaned securities. At

December 31, 2006, we had security loans outstanding with a

fair value of $780 million, and we held cash in the amount of

$807 million as collateral for these loaned securities. At

December 31, 2005, we had security loans outstanding with a

fair value of $605 million, and we held cash in the amount of

$622 million as collateral for these loaned securities.

During 2006, we reclassified an investment from held to

maturity to available for sale as a result of the issuer’s credit

rating downgrade. At the date of transfer, this debt security

had an amortized cost of $118 million.

During 2005, we reclassified an investment from held to

maturity to available for sale as a result of the issuer’s credit

rating downgrade. This debt security had an amortized cost of

$254 million at the date of transfer.

During 2004, we reclassified two debt securities from held to

maturity to available for sale. The first transfer resulted from

the issuer’s credit rating downgrade. At the time of transfer,

the debt security had an amortized cost of $118 million.

Included in accumulated other comprehensive income

immediately prior to the transfer was an unamortized gain of

$24 million related to this security. This gain represented the

remaining unamortized portion of a $32 million gain

established in 2001, when we reclassified this investment from

available for sale to held to maturity. The second transfer

resulted from the deterioration in the issuer’s credit

worthiness. At the time of transfer, this debt security had an

amortized cost of $291 million.

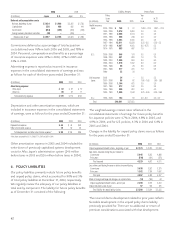

4. FINANCIAL INSTRUMENTS

The carrying values and estimated fair values of the Company’s

financial instruments as of December 31 were as follows:

2006 2005

Carrying Fair Carrying Fair

(In millions) Value Value Value Value

Assets:

Fixed-maturity securities $ 42,288 $ 42,174 $ 39,009 $ 38,981

Perpetual debentures 8,398 8,432 8,542 8,622

Equity securities 25 25 84 84

Liabilities:

Notes payable (excl. capitalized leases) 1,416 1,421 1,382 1,395

Cross-currency and interest rate swaps 77 12 12

Obligation to Japanese policyholder

protection fund 175 175 203 203

The methods of determining the fair values of our investments

in debt and equity securities are described in Note 3. The fair

values of notes payable with fixed interest rates were obtained

from an independent financial information service. The fair

values of our cross-currency swaps are the expected amounts