Aflac 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

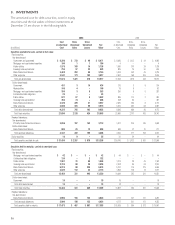

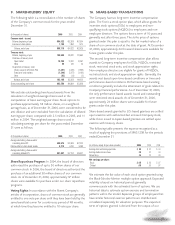

The components of net investment income for the years

ended December 31 were as follows:

(In millions) 2006 2005 2004

Fixed-maturity securities $ 1,782 $ 1,693 $ 1,621

Perpetual debentures 387 378 349

Equity securities and other 211

Short-term investments and cash equivalents 20 20 7

Gross investment income 2,191 2,092 1,978

Less investment expenses 20 21 21

Net investment income $ 2,171 $ 2,071 $ 1,957

Investment exposures, which individually exceeded 10% of

shareholders’ equity as of December 31, were as follows:

2006 2005

Credit Amortized Fair Credit Amortized Fair

(In millions) Rating Cost Value Rating Cost Value

Japan National Government AA $ 7,849 $ 8,536 AA $ 8,178 $ 9,167

HSBC** ***AA/A 784* 850

*Less than 10%

**For this issuer, we own more than one security with different ratings.

Privately issued securities held by Aflac Japan at amortized

cost accounted for $31.3 billion, or 64.0%, of total debt

securities at December 31, 2006, compared with $27.9 billion,

or 61.8%, of total debt securities at December 31, 2005. Total

privately issued securities, at amortized cost, accounted for

$33.6 billion, or 68.8%, of our total debt securities as of

December 31, 2006, compared with $30.1 billion, or 66.6%, at

December 31, 2005. Of the total privately issued securities,

reverse-dual currency debt securities (principal payments in

yen, interest payments in dollars) accounted for $9.7 billion, or

28.9%, at amortized cost as of December 31, 2006, compared

with $8.9 billion, or 29.6%, at amortized cost as of December

31, 2005.

At December 31, 2006, we owned below-investment-grade

debt securities in the amount of $1.3 billion at amortized cost

($1.1 billion at fair value), or 2.6% of total debt securities,

compared with $1.1 billion at amortized cost ($886 million at

fair value), or 2.3% of total debt securities a year ago. Each of

the below-investment-grade securities was investment grade

at the time of purchase and was subsequently downgraded by

credit rating agencies. These securities are held in the

available-for-sale portfolio.

As of December 31, 2006, $91 million, at fair value, of Aflac

Japan’s debt securities had been pledged to Japan’s

policyholder protection fund. At December 31, 2006, debt

securities with a fair value of $13 million were on deposit with

regulatory authorities in the United States and Japan. We

retain ownership of all securities on deposit and receive the

related investment income.

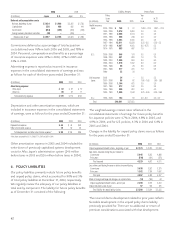

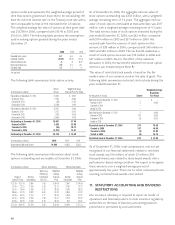

Information regarding realized and unrealized gains and losses

from investments for the years ended December 31 follows:

(In millions) 2006 2005 2004

Realized investment gains (losses) on securities:

Debt securities:

Available for sale:

Gross gains from sales $ 67 $ 284 $ 36

Gross losses from sales (34) (22) (54)

Net gains (losses) from redemptions 4(1) 6

Total debt securities 37 261 (12)

Equity securities:

Gross gains from sales 43 11

Impairment losses (1) – (1)

Total equity securities 42 1–

Total realized investment gains (losses) $ 79 $ 262 $ (12)

Changes in unrealized gains (losses):

Debt securities:

Available for sale $ (624) $ (697) $ 216

Transferred to held to maturity (52) (113) (64)

Equity securities (45) 11 4

Change in unrealized gains (losses) $ (721) $ (799) $ 156

In 2006, we realized pretax gains of $79 million (after-tax, $51

million, or $.10 per diluted share) primarily as a result of bond

swaps and the liquidation of equity securities held by Aflac

U.S. In 2005, we realized pretax gains of $262 million (after-

tax, $167 million, or $.33 per diluted share) primarily as a

result of bond swaps. We began our bond-swap program in

the second half of 2005 and concluded it in the first half of

2006. These bond swaps took advantage of tax loss

carryforwards and also resulted in an improvement in overall

portfolio credit quality and investment income.

During 2004, we received an issuer’s offer to redeem certain

available-for-sale yen-denominated debt securities held by the

Company. We accepted the issuer’s offer of $205 million and

recorded a pretax loss of $23 million. This investment loss and

other investment gains and losses in the normal course of

business decreased pretax earnings by $12 million (after-tax $5

million, or $.01 per diluted share).

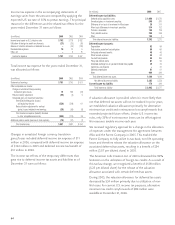

Fair values of debt securities and privately issued equity

securities were determined using quotations provided by

outside securities pricing sources and/or compiled using data

provided by external debt and equity market sources. The data

used in estimating fair value include credit spreads of

comparably credit-rated securities and market quotations of

securities with similar maturity and call structure

characteristics. Fair values are then computed using standard