ADT 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

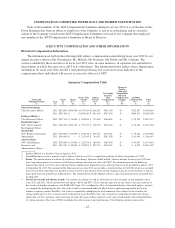

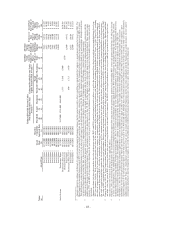

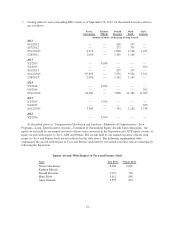

Estimated Possible Payouts Under

Non-Equity Incentive Plan

Awards (1)

Estimated Possible Payouts Under

Equity Incentive Plan Awards (2)

All Other

Stock

Awards:

Number of

Shares

of Stock or

Units

(#)

(j)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#)

(k)

Exercise or

Base

Price of

Option

Awards

($/Sh)

(l)

Grant Date

Fair Value of

Stock and

Option

Awards

($) (3)

(m)

Name

(a) Award Type

Grant

Date

(b)

Board or

Committee

Approval Date

(c)

Threshold

($)

(d)

Target

($)

(e)

Maximum

($)

(f)

Threshold

(#)

(g)

Target

(Mid-Point)

(#)

(h)

Maximum

(#)

(i)

Stock Option (6) 12/11/2003 10/12/2011 9,442 $39.38 $ 12,429

Stock Option (6) 3/26/2004 10/12/2011 8,812 $44.16 $ 10,309

Stock Option (6) 3/10/2005 10/12/2011 7,364 $56.87 $ 4,899

Stock Option (6) 11/22/2005 10/12/2011 6,294 $46.07 $ 6,485

Stock Option (6) 10/7/2008 10/12/2011 2,463 $29.00 $ 4,046

Stock Option (6) 10/1/2009 10/12/2011 2,645 $33.75 $ 4,103

Stock Option (6) 10/12/2010 10/12/2011 9,830 $37.29 $ 14,902

Stock Option (6) 10/12/2011 10/12/2011 11,030 $44.32 $ 15,674

Anita Graham Performance Bonus 12/7/2011 12/7/2011 $117,000 $234,000 $468,000

Performance Share Unit 10/12/2011 10/12/2011 1,553 3,450 6,900 $170,488

Restricted Stock Unit 10/12/2011 10/12/2011 3,350 $148,472

Stock Option 10/12/2011 10/12/2011 12,400 $44.32 $151,392

Performance Share Unit (5) 10/12/2011 8/2/2012 690 1,725 3,450 $ 3,518

Stock Option (6) 5/4/2011 10/12/2011 12,833 $48.68 $ 15,681

Stock Option (6) 10/12/2011 10/12/2011 12,400 $44.32 $ 17,623

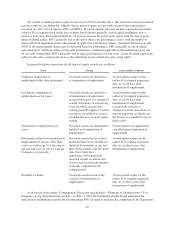

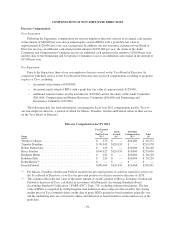

(1) Amounts reported in columns (d) through (f) represent potential annual performance bonuses that the named executive officers could have earned under the Company’s annual incentive plan for fiscal year 2012. The

Board approved a maximum bonus payout of 0.25% of net income before special items for Mr. Gursahaney, subject to a cap of $2.5 million. The Committee further established a maximum payout of 200% of target.

Threshold amounts assume minimum performance levels are achieved with respect to each performance measure. For Ms. Mikells, amount represents annualized threshold, target and maximum, although actual bonus

was pro-rated based upon her actual hire date as discussed above in “Compensation Discussion and Analysis—Elements of Compensation—Tyco Programs—Annual Incentive Compensation.”

(2) Amounts in (g) through (i) represent potential share payouts with respect to performance share awards that were made in connection with the fiscal year 2012 long-term compensation grant. In connection with the

modification of these awards described in footnote 5 below, performance results were determined as of June 29, 2012 and the number of shares deliverable upon vesting has been determined. These amounts range

between 179% and 200% of target amounts depending on the year of grant. See page 41 for a discussion of performance results. Share amounts reflect the awards prior to their modification in connection with the

Separation.

(3) Amounts in column (m) show the grant date fair value of the option awards, RSUs and PSUs granted to named executive officers, as well as the incremental fair value for awards that were modified during fiscal year

2012 (see footnotes 5 and 6). These amounts represent the fair value of the entire amount of the award calculated in accordance with Financial Accounting Standards Board ASC Topic 718 (ASC Topic 718), excluding

the effect of estimated forfeitures. For grants of stock options, amounts are computed by multiplying the fair value of the award (as determined under the Black-Scholes option pricing model) by the total number of

options granted. For grants of RSUs, fair value is computed by multiplying the total number of shares subject to the award by the closing market price of Tyco common stock on the date of grant. For grants of PSUs,

fair value is based on a model that considers the closing market price of Tyco common stock on the date of grant, the range of shares subject to such stock award, and the estimated probabilities of vesting outcomes.

The value of PSUs included in the table assumes target performance. However, the actual number of shares that will be delivered with respect to the PSUs was determined based on performance through June 29, 2012.

(4) During fiscal year 2012, the Tyco Compensation Committee ended the cash perquisite allowance program for all officers of the Company that received the benefit, including Messrs. Gursahaney, Boerema and Edoff,

and made a one-time grant of RSUs to existing officers who were receiving the benefit at the time it was terminated. The RSUs vest in equal installments over two years and had a grant date fair value equal to two

times the annual value of the cash allowance for the applicable officer.

(5) On July 12, 2012, in connection with the Separation, the Tyco Board of Directors approved the truncation of the performance periods for all outstanding PSUs so that each period ended on June 29, 2012 (the last day

of Tyco’s fiscal third quarter). This modification was necessary to complete the Separation, as the performance metrics applicable to the PSUs would no longer be meaningful following the Separation. The awards

maintained their original vesting schedule. Performance through June 29, 2012 was reviewed and certified by the Tyco Compensation Committee on August 2, 2012. Refer to page 41 in the Compensation Discussion

and Analysis for details on the performance results. For modified PSUs, amounts in column (m) represent the incremental fair value of these modifications calculated in accordance with ASC Topic 718.

(6) On October 12, 2011 the Tyco Compensation Committee approved the conversion methodology for all outstanding Tyco equity awards that would apply at the completion of the Separation. The conversion

methodology was designed to preserve the intrinsic value of each form of equity award. In general, equity awards were either (i) converted into equity awards solely in respect of the stock of the employee’s post-

separation employer or (ii) converted into equity awards with respect to each of Tyco, Pentair and ADT. Although these conversions preserved the intrinsic value of each type of award, in some cases they constituted a

modification under ASC Topic 718, which requires a comparison of fair values of awards immediately before the Separation and the fair values immediately after the Separation. In certain instances, the fair value of

stock options immediately after the Separation was higher. As a result, the modification resulted in incremental compensation costs for these awards, which are reported in column (m).

-48-