ADT 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

grant, unless forfeited earlier. RSUs granted by Tyco generally vested over a period of four years in equal

installments. RSUs accrued dividend-equivalent units during the vesting period, which vested and were delivered

upon settlement, and did not carry voting rights until they were settled in shares. Vesting provisions related to

various termination scenarios are described below under the “Grants of Plan Based Awards” table. No equity

awards held by our named executive officers vested as a result of the Separation.

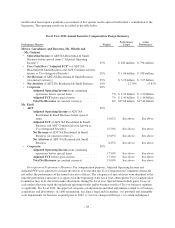

Due to the pending Separation, the performance period for the fiscal 2012 PSU awards was originally the

one year period ending on the expected closing date of the Separation. The performance metrics for the 2012

PSUs consisted of a return on invested capital (“ROIC”) measure (50% weighting) and a relative total

shareholder return (“TSR”) measure (50% weighting). The ROIC metric was designed to reward executives for

efficiently allocating capital and generating profitable growth. Minimum, target and maximum thresholds for

each performance metric are described below:

Min

% of Target

Earned Target

% of Target

Earned Max

% of Target

Earned

Relative TSR (50% weight) 35th pct. 40% 50th pct. 100% 75th pct. 200%

Improvement in ROIC (50% weight) 10 bp 50% 50 bp 100% 90 bp 200%

In order to facilitate the Separation timeline, the Tyco Compensation Committee approved the conversion of

all outstanding PSUs into time-based RSUs based on performance achieved through the end of Tyco’s third fiscal

quarter (June 29, 2012). Following the announcement of the Pentair / Flow Control Merger transaction, and to

facilitate diluted share calculations required for the transaction, the Tyco Compensation Committee and the Tyco

Board of Directors approved the truncation of the performance periods for all outstanding PSUs so that each

period ended on June 29, 2012 (the last day of Tyco’s fiscal third quarter). This modification was necessary to

complete the Separation, as the performance metrics applicable to the PSUs would no longer be meaningful

following the Separation, and precise diluted share calculations were required to complete the Tyco Flow Control

/ Pentair Inc. merger transaction. Performance metrics were also adjusted to take into account the shortened

performance periods, although the vesting schedules for the PSUs were not changed. Thus, while the number of

shares to be delivered in respect of PSUs was determined based on results through June 29, 2012, participants

(other than employees who were terminated in connection with the Separation) are generally required to hold the

PSUs through the original vesting date before the full amount of shares become deliverable.

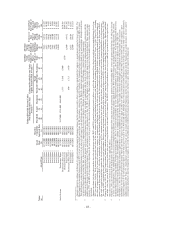

The chart below illustrates the impact of these modifications:

Timeline

FY2010

Grant Metric: Method: Results:

Metric: Method: Results:

Metric: Method: Results:

- 100% Relative TSR 200%

200%

200%

200%

FY2011

Grant

- 50% Relative TSR

- 50% Cumulative EPS

FY2012

Grant

- 50% Relative TSR

- Compare to the 3Qs of 2011 and reduce

the target improvement level by 25%

= Original Performance Period =Time Vesting

Truncation

6/29/2012

FY 2010 FY 2011 FY 2012 FY 2013 FY 2014

- 50% ROIC basis point

improvement

- Reduce performance period by one quarter

- Reduce period by five quarters

- Prorate based on 12% annual growth rate 159%

- Reduce period by one quarter

-40-