ADT 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

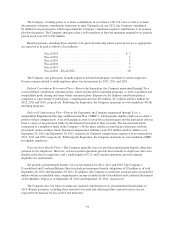

ADT Dealer Litigation

As previously reported, in 2002, a number of former dealers and related parties have filed lawsuits against

the Company in the United States and in other countries, including a class action lawsuit filed in the District

Court of Arapahoe County, Colorado, alleging breach of contract and other claims related to the Company’s

decision to terminate certain authorized dealers in 2002 and 2003. In February 2010, the Court granted a directed

verdict in the Company’s favor dismissing a number of the plaintiffs’ key claims. Upon appeal, the Colorado

Court of Appeals affirmed the verdict in the Company’s favor in October 2011. The parties agreed to settle this

matter in April 2012 with no cash consideration being paid by either side, which is subject to final court

approval.

Telephone Consumer Protection Act

The Company has been named as a defendant in two putative class actions that were filed on behalf of

purported classes of persons who claim to have received unsolicited “robocalls” in contravention of the U.S.

Telephone Consumer Protection Act (“TCPA”). These lawsuits were brought by plaintiffs seeking class action

status and monetary damages on behalf of all plaintiffs who allegedly received such unsolicited calls, claiming

that millions of calls were made by third party entities on the Company’s behalf. The Company asserts that such

entities were not retained by, nor authorized to make calls on behalf of, the Company. The Company has entered

into a preliminary agreement to settle this litigation, and is in the process of preparing definitive settlement

documentation. The Company has increased its legal reserves by $15 million to reflect this development. The

settlement is subject to the completion of satisfactory settlement documentation and approval of the District

Court.

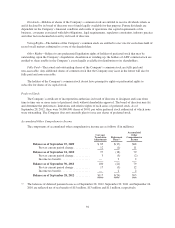

Income Tax Matters

As discussed above in Note 6, the 2012 Tax Sharing Agreement governs the rights and obligations of ADT,

Tyco and Pentair for certain tax liabilities with respect to periods or portions thereof ending on or before the date

of the Distribution. ADT is responsible for all of its own taxes that are not shared pursuant to the 2012 Tax

Sharing Agreement’s sharing formulae. Tyco and Pentair are responsible for their tax liabilities that are not

subject to the 2012 Tax Sharing Agreement’s sharing formulae.

With respect to years prior to and including the 2007 separation of Covidien and TE Connectivity by Tyco,

tax authorities have raised issues and proposed tax adjustments that are generally subject to the sharing

provisions of the 2007 Tax Sharing Agreement and which may require Tyco to make a payment to a taxing

authority, Covidien or TE Connectivity. Although Tyco advised ADT that it has resolved a substantial number of

these adjustments, a few significant items remain open with respect to the audit of the 1997 through 2004 years.

As of the date hereof, it is unlikely that Tyco will be able to resolve all the open items, which primarily involve

the treatment of certain intercompany debt transactions during the period, through the IRS appeals process. As a

result, Tyco has advised ADT that it expects to litigate these matters once it receives the requisite statutory

notices from the IRS, which is expected to occur during fiscal year 2013. Tyco has advised us that it has

determined that its recorded liability is sufficient to cover the indemnifications Tyco made under the 2007 Tax

Sharing Agreement. However, the ultimate resolution of these matters is uncertain and could result in Tyco being

responsible for a greater amount than it expects under the 2007 Tax Sharing Agreement.

84