ADT 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

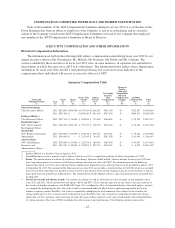

Description Change-in-Control

Other Terminations (not Change-in-

Control)

Outplacement assistance: Up to 12 months. At the Company’s discretion for

up to 12 months.

Excise tax gross-up payment: No. N/A

IRC Section 280G Cap on Benefits: Yes, if the cap results in greater

after tax payments to executive,

otherwise benefits are not capped.

N/A

Restrictive covenants: Subject to confidentiality and non-

disparagement covenants.

• Prohibited from soliciting

customers and employees of

the Company for two years

from the date of termination.

• Prohibited from competing

with the Company for one

year from the date of

termination.

• Subject to confidentiality and

non-disparagement

covenants.

(1) Upon death or disability, equity awards generally vest in full, subject to performance conditions for PSUs.

The Severance Plan generally defines “Cause” as an executive’s (i) substantial failure or refusal to perform

duties and responsibilities of his or her job as required by the Company; (ii) violation of any fiduciary duty owed

to the Company; (iii) conviction of a felony or misdemeanor; (iv) dishonesty; (v) theft; (vi) violation of Company

rules or policy; or (vii) other egregious conduct, that has or could have a serious and detrimental impact on the

Company and its employees. The administrator of the Severance Plan, in its sole and absolute discretion,

determines whether Cause exists.

The CIC Severance Plan provides the benefits outlined above only if, during the 60-day period prior to and

the two-year period following a Change in Control, a Change in Control Termination occurs. The CIC Severance

Plan generally defines “Cause” as (i) a material violation of any fiduciary duty owed to the Company;

(ii) conviction of or entry of a plea of nolo contendere with respect to, a felony or misdemeanor; (iii) dishonesty;

(iv) theft; or (v) other egregious conduct, that is likely to have a materially detrimental impact on the Company

and its employees. Whether an executive’s termination is due to “Cause” under the CIC Severance Plan is

determined by the administrator of the CIC Severance Plan.

The CIC Severance Plan generally defines “Good Reason Resignation” as any retirement or termination of

employment by an executive that is not initiated by the Company and that is caused by any one or more of the

following events, provided the event occurs in the period beginning 60 days before the change in control date and

ending two years after that date:

• Without the executive’s written consent, the Company assigns the executive any duties inconsistent in

any material respect with his or her authority, duties or responsibilities or any other action by the

Company which results in a significant diminution in such authority, duties or responsibilities;

• Without the executive’s written consent, the Company makes a material change in the geographic

location at which the executive performs services to a location that is more than 50 miles from his or

her existing principal place of employment;

• Without the executive’s written consent, the Company materially reduces the executive’s base

compensation and benefits, taken as a whole; or

-36-