ADT 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The supplemental pro forma financial information is based on the historical financial information for the

Company and BHS. The supplemental pro forma financial information for the period ended September 24, 2010

utilized BHS’ historical financial information for its fiscal fourth quarter ended December 31, 2009 and the

pre-acquisition period from January 1, 2010 through the acquisition date. The supplemental pro forma financial

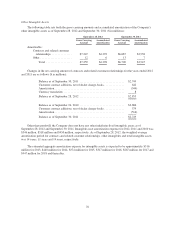

information reflects primarily the following pro forma pre-tax adjustments:

• Elimination of BHS historical intangible asset amortization and property and equipment depreciation

expense;

• Elimination of BHS historical deferred acquisition costs amortization;

• Elimination of BHS historical deferred revenue amortization;

• Additional amortization and depreciation expense related to the fair value of identifiable intangible

assets and property and equipment acquired; and

• All of the above pro forma adjustments were tax effected using a statutory tax rate of 39%

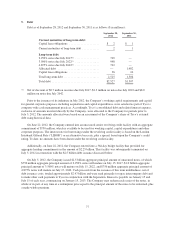

The supplemental pro forma financial information for the year ended September 24, 2010 reflect the

following non-recurring adjustments:

• Direct acquisition costs primarily relating to advisory and legal fees and integration costs; and

• Restructuring charges primarily related to employee severance and one-time benefit arrangements

The supplemental pro forma financial information gives effect to the acquisition, but should not be

considered indicative of the results that would have occurred in the periods presented above, nor are they

indicative of future results. In addition, the supplemental pro forma financial information does not reflect the

potential realization of cost savings relating to the integration of the two companies.

Acquisition and Integration Related Costs

During the year ended September 24, 2010, the Company incurred approximately $17 million of costs

directly related to the acquisition of Broadview Security and recorded $14 million of restructuring expenses in

conjunction with the acquisition of Broadview Security. These costs are reflected in selling, general and

administrative expenses in the Company’s Consolidated and Combined Statement of Operations for the year

ended September 24, 2010

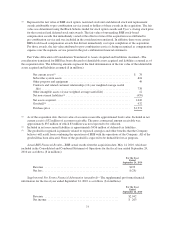

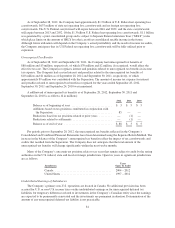

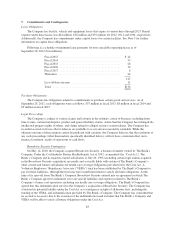

In addition, during the years ended September 28, 2012, September 30, 2011 and September 24, 2010, the

Company incurred costs related to the integration of Broadview Security. A summary of the integration related

costs and the line item presentation of these amounts in the Company’s Consolidated and Combined Statement of

Operations is as follows ($ in millions):

2012 2011 2010

Cost of revenue .................................. $— $ 2 $—

Selling, general and administrative expenses ........... 14 26 18

Total integration related costs ................... $ 14 $28 $ 18

74