ADT 2012 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

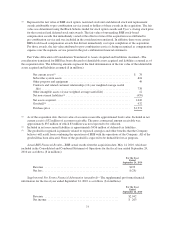

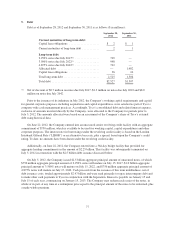

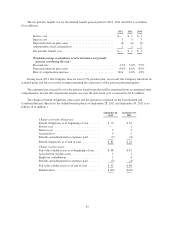

Aggregate annual maturities of long-term debt and capital lease obligations are as follows ($ in millions):

Fiscal 2013 ......................................... $ 6

Fiscal 2014 ......................................... 6

Fiscal 2015 ......................................... 6

Fiscal 2016 ......................................... 6

Fiscal 2017 ......................................... 756

Thereafter .......................................... 1,777

Total .............................................. 2,557

Less amount representing discount on notes ........... 11

Less amount representing interest on capital leases ...... 19

Total .............................................. 2,527

Less current maturities of long-term debt ............. 2

Total long-term debt .................................. $2,525

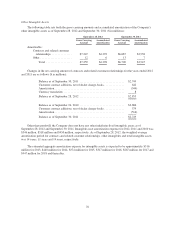

6. Income Taxes

Prior to the Separation, the Company’s operating results were included in Tyco’s various consolidated U.S.

federal and state income tax returns, as well as non-U.S. tax filings in Canada and certain U.S. territories. For

purposes of the Company’s Consolidated and Combined Financial Statements for periods prior to the Separation,

income tax expense has been recorded as if the Company filed tax returns on a standalone basis separate from

Tyco. The Separate Return Method applies the accounting guidance for income taxes to the standalone financial

statements as if the Company was a separate taxpayer and a standalone enterprise for the periods prior to

September 28, 2012.

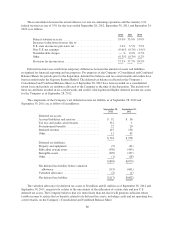

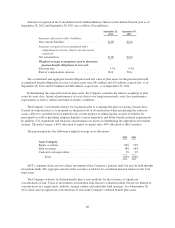

Significant components of income before income taxes for the years ended September 28, 2012,

September 30, 2011 and September 24, 2010 are as follows ($ in millions):

2012 2011 2010

United States ........................................... $581 $543 $336

Non-U.S. .............................................. 49 61 62

$630 $604 $398

Significant components of the income tax provision for the years ended September 28, 2012, September 30,

2011 and September 24, 2010 are as follows ($ in millions):

2012 2011 2010

Current:

United States: ......................................

Federal ........................................ $170 $228 $169

State .......................................... 36 33 35

Non-U.S. .......................................... 8 20 16

Current income tax provision .............................. $214 $281 $220

Deferred:

United States: ......................................

Federal ........................................ $ 21 $(50) $ (60)

State .......................................... (6) — 1

Non-U.S. .......................................... 7 (3) (2)

Deferred income tax provision ......................... 22 (53) (61)

$236 $228 $159

79