ADT 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

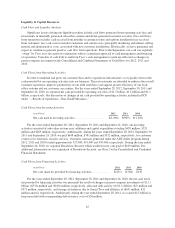

Liquidity & Capital Resources

Cash Flow and Liquidity Analysis

Significant factors driving our liquidity position include cash flows generated from operating activities and

investments in internally generated subscriber systems and dealer generated customer accounts. Our cash flows

from operations includes cash received from monthly recurring revenue and upfront installation fees received

from customers, less cash costs to monitor customers and certain costs, principally marketing and indirect selling,

general and administrative costs, associated with new customer installations. Historically, we have generated and

expect to continue to generate positive cash flow from operations. Prior to the Separation, our cash was regularly

“swept” by Tyco at its discretion in conjunction with its centralized approach to cash management and financing

of operations. Transfers of cash both to and from Tyco’s cash management system are reflected as changes in

parent company investment in the Consolidated and Combined Statements of Cash Flows for 2012, 2011 and

2010.

Cash Flows from Operating Activities

In order to maintain and grow our customer base and to expand our infrastructure, we typically reinvest the

cash provided by our operating activities into our business. These investments are intended to enhance the overall

customer experience, improve productivity of our field workforce and support greater efficiency of our back

office systems and our customer care centers. For the years ended September 28, 2012, September 30, 2011 and

September 24, 2010, we reported net cash provided by operating activities of $1.5 billion, $1.4 billion and $1.1

billion, respectively. See discussion of changes in net cash provided by operating activities included in FCF

under “—Results of Operations—Non-GAAP Measures.”

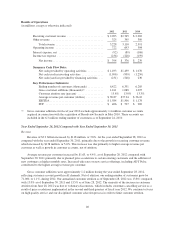

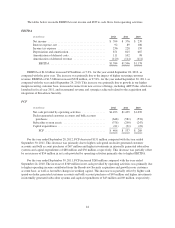

Cash Flows from Investing Activities

(in millions) 2012 2011 2010

Net cash used in investing activities .................... $(1,096) $(909) $(1,250)

For the years ended September 28, 2012, September 30, 2011 and September 24, 2010, our investing

activities consisted of subscriber system asset additions and capital expenditures totaling $439 million, $321

million and $269 million, respectively. Additionally, during the years ended September 28, 2012, September 30,

2011 and September 24, 2010, we paid $648 million, $581 million and $532 million, respectively, for customer

contracts for electronic security services. Customer contracts generated under the ADT dealer program during

2012, 2011 and 2010 totaled approximately 527,000, 491,000 and 459,000, respectively. During the year ended

September 24, 2010, we acquired Broadview Security which resulted in net cash paid of $449 million. For

additional information on our acquisition of Broadview Security, see Note 2 to the Consolidated and Combined

Financial Statements.

Cash Flows from Financing Activities

(in millions) 2012 2011 2010

Net cash (used in) provided by financing activities ............ $(231) $(548) $230

For the years ended September 28, 2012, September 30, 2011 and September 24, 2010, the net cash (used

in) provided by financing activities was primarily the result of changes in parent company investment of ($1.1)

billion, ($574) million and ($140) million, respectively, allocated debt activity of ($1.5) billion, ($5) million and

$371 million, respectively, and changes in balances due to (from) Tyco and affiliates of ($63) million, $32

million and nil, respectively. Additionally, during the year ended September 28, 2012, we issued $2.5 billion in

long-term debt with corresponding debt issuance costs of $26 million.

45