ADT 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

available. Revenue recognized for equipment and installation is limited to the lesser of their allocated amounts

under the estimated selling price hierarchy or the non-contingent up-front consideration received at the time of

installation, since collection of future amounts under the arrangement with the customer is contingent upon the

delivery of monitoring and maintenance services.

Provisions for certain rebates and discounts to customers are accounted for as reductions in revenue in the

same period the related revenue is recorded. These provisions are based on terms of arrangements with direct,

indirect and other market participants. Rebates are estimated based on sales terms, historical experience and trend

analysis.

The Company records estimated product warranty costs at the time of sale. The carrying amounts of the

Company’s warranty accrual as of September 28, 2012 and September 30, 2011 were not material.

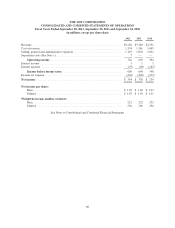

Advertising—Advertising costs which amounted to $155 million, $152 million and $113 million for 2012,

2011 and 2010, respectively, are expensed when incurred and are included in selling, general and administrative

expenses.

Acquisition Costs—Acquisition costs are expensed when incurred and are included in selling, general and

administrative expenses. See Note 2.

Separation Costs—During the year ended September 28, 2012, the Company incurred approximately $10

million in charges directly related to the Separation. Of these costs, $7 million is included in separation costs and

$3 million is included in interest expense on the Company’s Consolidated and Combined Statement of

Operations. See Note 5 for information on interest expense.

Translation of Foreign Currency—The Company’s Consolidated and Combined Financial Statements are

reported in U.S. dollars. A portion of the Company’s business is transacted in Canadian dollars. The Company’s

Canadian entity maintains its records in Canadian dollars. The assets and liabilities are translated into U.S.

dollars using rates of exchange at the balance sheet date and translation adjustments are recorded in accumulated

other comprehensive income. Revenue and expenses are translated at average rates of exchange in effect during

the year.

Cash and Cash Equivalents—All highly liquid investments with original maturities of three months or less

from the time of purchase are considered to be cash equivalents.

Allowance for Doubtful Accounts—The allowance for doubtful accounts receivable reflects the best estimate

of probable losses inherent in the Company’s receivable portfolio determined on the basis of historical

experience and other currently available evidence.

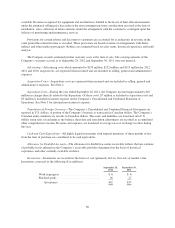

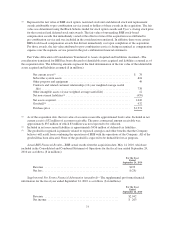

Inventories—Inventories are recorded at the lower of cost (primarily first-in, first-out) or market value.

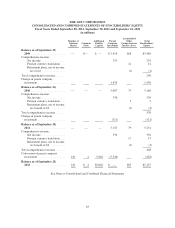

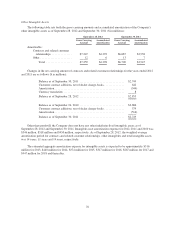

Inventories consisted of the following ($ in millions):

September 28,

2012

September 30,

2011

Work in progress ........................... $ 6 $ 6

Finished goods ............................. 36 27

Inventories ............................ $42 $33

66