ADT 2012 Annual Report Download - page 58

Download and view the complete annual report

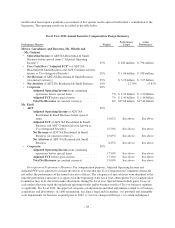

Please find page 58 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Base Salary

During fiscal year 2012, the Tyco Compensation Committee determined that each of our named executive

officers, other than Ms. Mikells, who was hired on April, 30, 2012, should receive an increase in base salary

following the Separation to reflect their new roles and increased responsibilities with ADT. These salary

increases were approved by our Board and are effective for fiscal year 2013 as noted in the table above.

Upon the completion of the Separation, each of our named executive officers (other than Ms. Mikells)

received a one-time cash payment equal to the difference between their targeted cash compensation for fiscal

year 2012 (base salary and target annual incentive award) and their new targeted cash compensation, prorated for

the period from April 1 to September 28, 2012. The April 1, 2012 date was selected because it was the first day

of the month following the approval of the post-Separation compensation by the Tyco Compensation Committee.

This payment was made in consideration of the increased duties assumed by these individuals prior to the

Separation in connection with their promotions and their new roles with ADT following the Separation.

Our Compensation Committee will review the base salaries of our named executive officers annually to

determine whether they adequately reward our executives for their services and remain competitive in the market

for talent.

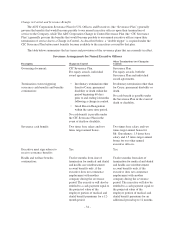

Annual Incentive Compensation

For fiscal year 2013, each of our named executive officers will participate in our Officer Short-Term Bonus

Plan, which is a subplan under our 2012 Stock and Incentive Plan and is intended to qualify as performance-

based compensation under Section 162(m) of the Code. Under the Officer Short-Term Bonus Plan, our

Compensation Committee selects an objective maximum formula for annual incentive bonuses, based on the

achievement of certain performance goals (excluding certain pre-determined items). For fiscal year 2013, our

Compensation Committee established operating income as the objective performance measure for purposes of

determining the maximum annual incentive bonus for our named executive officers. Our Compensation

Committee also establishes a guideline formula that will be used to apply negative discretion to the maximum

formula to arrive at the actual bonus received by a participant.

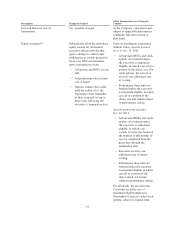

For fiscal year 2013, the guideline formula for annual incentive bonuses will be based on the achievement of

financial goals (80%) and individual goals (20%), with the exception of the guideline formula for Mr. Gursahaney’s

award, which will be based 100% on the achievement of Company financial goals. The Company financial goals

are based on recurring revenue growth (30% weighting), adjusted free cash flow (30% weighting) and net attrition

(20% weighting). Adjusted free cash flow is defined as free cash flow before cash interest expense and adjusted for

certain items, such as material variances from targeted gross account additions and targeted Pulse penetration to

ensure the financial target appropriately encourages investment for long term growth. In addition, the achievement

of financial goals for the Chief Executive Officer, senior officers and senior executives may be adjusted +/- 20%

based upon achievement of certain strategic modifiers which are related to specific internal financial goals focused

on driving the long-term health and growth of our business. Individual performance objectives have been included

in the design of our plan in order to improve line-of-sight for participants, and are aligned to specific value drivers

of our business. If the achievement of the Company’s financial goals is at the threshold level or below, satisfaction

of the individual goals will be capped at the threshold level of 50%. Pursuant to the guideline formula, payouts

under the Officer Short-Term Bonus Plan are capped at 200% of the target level. Our Compensation Committee

may exercise negative discretion with respect to awards under the Officer Short-Term Bonus Plan but may not

increase awards.

Long-Term Incentive Awards

In fiscal year 2013, our Compensation Committee granted long-term equity incentive awards to certain

employees including our named executive officers. These awards were in the form of stock options, restricted

stock units (“RSUs”) and performance share units (“PSUs”). Stock options and RSUs will vest in four equal

installments on each of the first four anniversaries of the date of grant. The exercise price of the stock options is

-32-