ADT 2012 Annual Report Download - page 183

Download and view the complete annual report

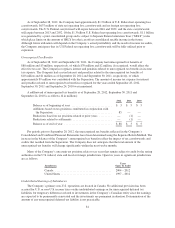

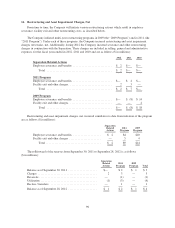

Please find page 183 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s funding policy is to make contributions in accordance with U.S. laws as well as to make

discretionary voluntary contributions from time-to-time. During fiscal year 2012, the Company contributed

$2 million to its pension plan, which represented the Company’s minimum required contributions to its pension

plan for that period. The Company anticipates that it will contribute at least the minimum required to its pension

plan in fiscal year 2013 of $2 million.

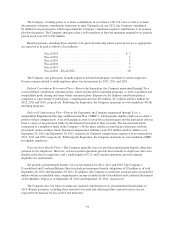

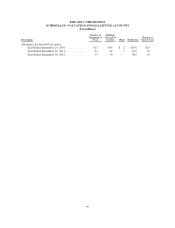

Benefit payments, including those amounts to be paid and reflecting future expected service as appropriate,

are expected to be paid as follows ($ in millions):

Fiscal 2013 ........................................... $ 3

Fiscal 2014 ........................................... 3

Fiscal 2015 ........................................... 3

Fiscal 2016 ........................................... 3

Fiscal 2017 ........................................... 4

Fiscal 2018 – Fiscal 2022 ................................ 20

The Company also participates in multi-employer defined benefit plans on behalf of certain employees.

Pension expense related to multi-employer plans was not material for 2012, 2011 and 2010.

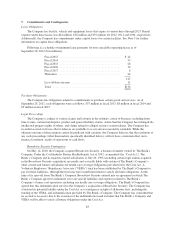

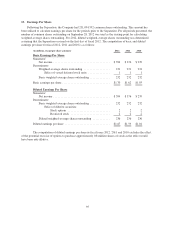

Defined Contribution Retirement Plans—Prior to the Separation, the Company maintained through Tyco

several defined contribution retirement plans, which include 401(k) matching programs, as well as qualified and

nonqualified profit sharing and share bonus retirement plans. Expense for the defined contribution plans is

computed as a percentage of participants’ compensation and was $22 million, $17 million and $14 million for

2012, 2011 and 2010, respectively. Following the Separation, the Company maintains its own standalone 401(k)

matching programs.

Deferred Compensation Plan—Prior to the Separation, the Company maintained through Tyco, a

nonqualified Supplemental Savings and Retirement Plan (“SSRP”), which permits eligible employees to defer a

portion of their compensation. A record keeping account is set up for each participant and the participant chooses

from a variety of measurement funds for the deemed investment of their accounts. The measurement funds

correspond to a number of funds in the Company’s 401(k) plans and the account balance fluctuates with the

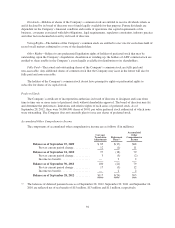

investment returns on those funds. Deferred compensation liabilities were $12 million and $11 million as of

September 28, 2012 and September 30, 2011, respectively. Deferred compensation expense was not material for

2012, 2011 and 2010, respectively. Following the Separation, the Company maintains its own standalone SSRP

for eligible employees.

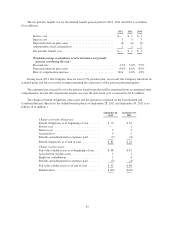

Postretirement Benefit Plans—The Company generally does not provide postretirement benefits other than

pensions for its employees. However, certain acquired operations provide these benefits to employees who were

eligible at the date of acquisition, and a small number of U.S. and Canadian operations provide ongoing

eligibility for such benefits.

Net periodic postretirement benefit cost was not material for 2012, 2011 and 2010. The Company’s

Consolidated and Combined Balance Sheets include postretirement benefit obligations of $5 million as of both

September 28, 2012 and September 30, 2011. In addition, the Company recorded net actuarial gains of nil and $1

million within accumulated other comprehensive income included in the Consolidated and Combined Statements

of Stockholders’ Equity as of September 28, 2012 and September 30, 2011, respectively.

The Company does not expect to make any material contributions to its postretirement benefit plans in

2013. Benefit payments, including those amounts to be paid and reflecting future expected service are not

expected to be material for fiscal 2013 and thereafter.

91