ADT 2012 Annual Report Download - page 162

Download and view the complete annual report

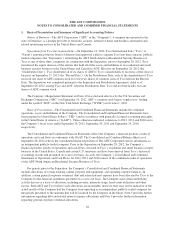

Please find page 162 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Concentration of Credit Risks—Financial instruments which potentially subject the Company to

concentrations of credit risks are principally accounts receivables. The Company’s concentration of credit risk

with respect to accounts receivable is limited due to the significant size of its customer base.

Insurable Liabilities—For fiscal years 2010 through 2012, the Company was insured for worker’s

compensation, property, product, general and auto liabilities through a captive insurance company that is a

wholly owned subsidiary of Tyco. The captive’s policies covering these risks are deductible reimbursement

policies. Tyco has insurance for losses in excess of the captive insurance company policies’ limits through third

party insurance companies. The captive insurance company retains the risk of loss, and therefore, Tyco has

retained the liability associated with claims incurred prior to the Separation. Following the Separation, the

Company maintains its own standalone insurance policies to manage certain of its insurable liabilities. See

Note 9 for additional information on insurable liabilities.

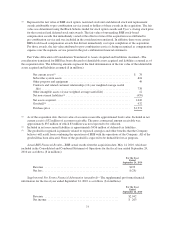

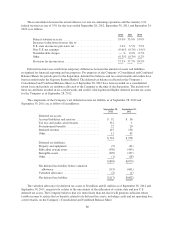

Financial Instruments—The Company’s financial instruments consist primarily of cash and cash

equivalents, accounts receivable, accounts payable and debt. Included in cash and cash equivalents as of

September 28, 2012 is approximately $187 million of available-for sale securities, representing cash invested in

money market mutual funds. These investments are classified as “Level 1” for purposes of fair value

measurement, which is performed each reporting period. Any unrealized holding gains or losses are excluded

from earnings and reported in other comprehensive income until realized. Any dividend or interest income

related to these investments is recognized in earnings. As these securities were purchased on the last day of the

fiscal year, the amount of unrealized holding gains, dividend income and interest income was immaterial for the

year ended September 28, 2012. The fair value of cash and cash equivalents, other than the money market mutual

funds, accounts receivable and accounts payable approximated book value as of September 28, 2012 because of

their short-term nature. The fair value of the money market mutual funds was approximately $187 million as of

September 28, 2012. See Note 5 for the fair value of the Company’s debt.

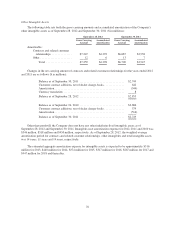

Reclassifications—Certain prior period amounts have been reclassified to conform with the current period

presentation. Specifically, the Company has reported amortization of deferred subscriber acquisition costs

separately on the Consolidated and Combined Statements of Cash Flows.

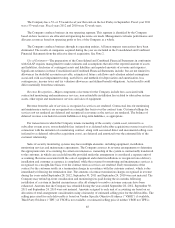

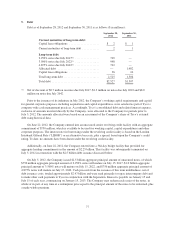

Recently Adopted Accounting Pronouncements—In September 2011, the FASB issued authoritative

guidance which expanded and enhanced the existing disclosure requirements related to multi-employer pension

and other postretirement benefit plans. The amendments require additional quantitative and qualitative

disclosures to provide more detailed information regarding these plans, including the significant multi-employer

plans in which the Company participates, the level of the Company’s participation and contributions with respect

to such plans, the financial health of such plans and an indication of funded status. These disclosures are intended

to provide users of financial statements with a better understanding of the employer’s involvement in multi-

employer benefit plans. The guidance became effective for the Company in the fourth fiscal quarter of 2012. The

adoption of the guidance did not have a material impact on the Company’s financial position, results of

operations or cash flows.

Recently Issued Accounting Pronouncements—In June 2011, the Financial Accounting Standards Board

(“FASB”) issued authoritative guidance for the presentation of comprehensive income. The guidance amended

the reporting of Other Comprehensive Income (“OCI”) by eliminating the option to present OCI as part of the

Consolidated and Combined Statements Stockholders’ Equity. The amendment does not impact the accounting

for OCI, but does impact its presentation in the Company’s Consolidated and Combined Financial Statements.

The guidance requires that items of net income and OCI be presented either in a single continuous statement of

comprehensive income or in two separate but consecutive statements which include total net income and its

components, consecutively followed by total OCI and its components to arrive at total comprehensive income. In

December 2011, the FASB issued authoritative guidance to defer the effective date for those aspects of the

guidance relating to the presentation of reclassification adjustments out of accumulated other comprehensive

income by component. The guidance must be applied retrospectively and is effective for the Company in the first

quarter of fiscal year 2013.

70