ADT 2012 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) Represents the fair value of BHS stock option, restricted stock unit and deferred stock unit replacement

awards attributable to pre-combination service issued to holders of these awards in the acquisition. The fair

value was determined using the Black-Scholes model for stock option awards and Tyco’s closing stock price

for the restricted and deferred stock unit awards. The fair value of outstanding BHS stock-based

compensation awards that immediately vested at the effective time of the acquisition was attributed to

pre-combination service and was included in the consideration transferred. In addition, there were certain

BHS stock-based compensation awards that did not immediately vest upon completion of the acquisition.

For those awards, the fair value attributed to post-combination service is being recognized as compensation

expense over the requisite service period in the post-combination financial statements.

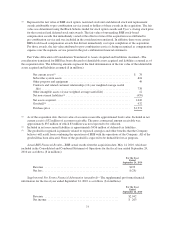

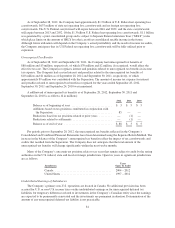

Fair Value Allocation of Consideration Transferred to Assets Acquired and Liabilities Assumed—The

consideration transferred for BHS has been allocated to identifiable assets acquired and liabilities assumed as of

the acquisition date. The following amounts represent the final determination of the fair value of the identifiable

assets acquired and liabilities assumed ($ in millions):

Net current assets(1) .................................................. $ 78

Subscriber system assets .............................................. 624

Other property and equipment .......................................... 49

Contracts and related customer relationships (10-year weighted average useful

life) ............................................................. 738

Other intangible assets (4-year weighted average useful life) .................. 12

Net non-current liabilities(2) ............................................ (459)

Net assets acquired ................................................... 1,042

Goodwill(3) ......................................................... 932

Purchase price ...................................................... $1,974

(1) As of the acquisition date, the fair value of accounts receivable approximated book value. Included in net

current assets is $32 million of accounts receivable. The gross contractual amount receivable was

approximately $35 million of which $3 million was not expected to be collected.

(2) Included in net non-current liabilities is approximately $456 million of deferred tax liabilities.

(3) The goodwill recognized is primarily related to expected synergies and other benefits that the Company

believes will result from combining the operations of BHS with the operations of the Company. All of the

goodwill has been allocated. None of the goodwill is expected to be deductible for tax purposes.

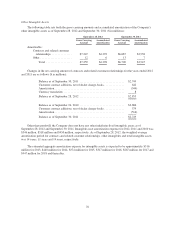

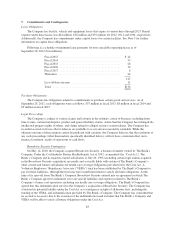

Actual BHS Financial Results—BHS actual results from the acquisition date, May 14, 2010, which are

included in the Consolidated and Combined Statement of Operations for the fiscal year ended September 24,

2010 are as follows ($ in millions):

For the Year

Ended

September 24, 2010

Revenue ................................................... $193

Net loss .................................................... $(25)

Supplemental Pro Forma Financial Information (unaudited)—The supplemental pro forma financial

information for the fiscal year ended September 24, 2010 is as follows ($ in millions):

For the Year

Ended

September 24, 2010

Revenue ................................................... $2,942

Net income ................................................. $ 263

73