ADT 2012 Annual Report Download - page 185

Download and view the complete annual report

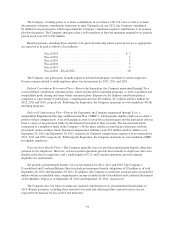

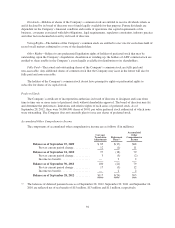

Please find page 185 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of September 28, 2012, there was approximately $7 million of total unrecognized compensation expense

related to non-vested stock options granted under the Company’s share option plan. This expense, net of

forfeitures is expected to be recognized over a weighted-average period of approximately 2.6 years. Of the

3.3 million unvested shares, the Company estimates that approximately 3.0 million will vest.

Use of a valuation model requires management to make certain assumptions with respect to selected model

inputs. When measuring the fair value immediately before and after the modification, specific consideration is

given to the assumptions used in the Black-Scholes option pricing model. Fair value immediately before the

modification is measured based on the assumptions of Tyco whereas the fair value of ADT options immediately

after the separation is representative of ADT. The weighted-average assumptions used in the Black-Scholes

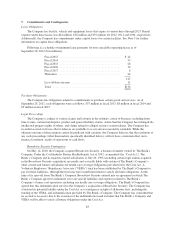

pricing model for options converted on September 28, 2012 were as follows:

Risk-free interest rate ............................. 1.01 – 1.21%

Expected life of options (years) ..................... 5.5–6.5

Expected annual dividend yield ..................... 1.42%

Expected stock price volatility ...................... 33%

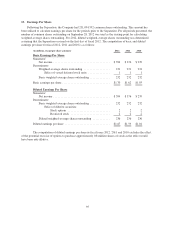

Restricted Stock Units—Restricted stock units are granted subject to certain restrictions. Conditions of

vesting are determined at the time of grant under the Plan. Restrictions on the award generally lapse upon normal

retirement, if more than twelve months from the grant date, and death or disability of the employee. Recipients of

restricted stock units have no voting rights and receive dividend equivalent units. Dividend equivalent units are

subject to forfeiture if the underlying awards do not vest. Included in the total number of restricted stock units

issued are approximately 0.6 million deferred stock units, all of which are vested as of September 28, 2012.

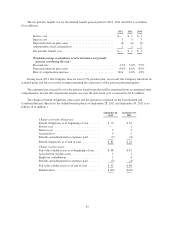

The fair market value of restricted stock units, both time vesting and those subject to specific performance

criteria, are expensed over the period of vesting. Restricted stock units that vest based upon passage of time

generally vest over a period of four years. The fair value of restricted stock units was determined based on the

closing market price of the underlying stock on the grant date. Restricted stock units that vest dependent upon

attainment of various levels of performance that equal or exceed targeted levels generally vest in their entirety

three years from the grant date.

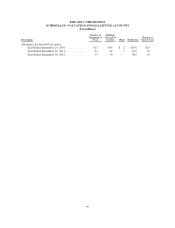

As of September 28, 2012, there were approximately 2.6 million shares of non-vested restricted stock units

outstanding. These shares had a weighted-average grant-date fair value of $20.86.

As of September 28, 2012, there was $13 million of total unrecognized compensation cost related to

non-vested restricted stock units. This expense, net of forfeitures is expected to be recognized over a weighted-

average period of approximately 3 years. Of the 2.6 million unvested shares, the Company estimates that

approximately 2.4 million will vest.

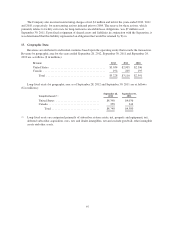

12. Equity

Authorized Capital Stock

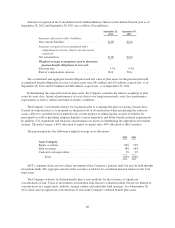

Immediately following the Separation, the Company’s authorized capital stock consisted of 1,000,000,000

shares of common stock, par value $0.01 per share, and 50,000,000 shares of preferred stock, par value $0.01 per

share.

Common Stock

Shares Outstanding—On September 28, 2012, Tyco completed a distribution of one common share of ADT

for every two common shares of Tyco. Following the Separation, the Company had 231,094,332 common shares

outstanding at a par value of $0.01 per share.

93