ADT 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends—Holders of shares of the Company’s common stock are entitled to receive dividends when, as

and if declared by its board of directors out of funds legally available for that purpose. Future dividends are

dependent on the Company’s financial condition and results of operations, the capital requirements of its

business, covenants associated with debt obligations, legal requirements, regulatory constraints, industry practice

and other factors deemed relevant by its board of directors.

Voting Rights—The holders of the Company’s common stock are entitled to one vote for each share held of

record on all matters submitted to a vote of the shareholders.

Other Rights—Subject to any preferential liquidation rights of holders of preferred stock that may be

outstanding, upon the Company’s liquidation, dissolution or winding-up, the holders of ADT common stock are

entitled to share ratably in the Company’s assets legally available for distribution to its shareholders.

Fully Paid—The issued and outstanding shares of the Company’s common stock are fully paid and

non-assessable. Any additional shares of common stock that the Company may issue in the future will also be

fully paid and non-assessable.

The holders of the Company’s common stock do not have preemptive rights or preferential rights to

subscribe for shares of its capital stock.

Preferred Stock

The Company’s certificate of incorporation authorizes its board of directors to designate and issue from

time to time one or more series of preferred stock without shareholder approval. The board of directors may fix

and determine the preferences, limitations and relative rights of each series of preferred stock. As of

September 28, 2012, there were 50,000,000 shares of $0.01 par value preferred stock authorized of which none

were outstanding. The Company does not currently plan to issue any shares of preferred stock.

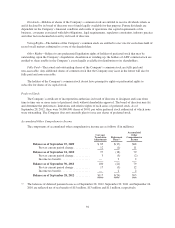

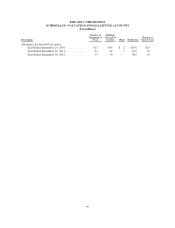

Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income are as follows ($ in millions):

Currency

Translation

Adjustments

Retirement

Plans(1)

Accumulated

Other

Comprehensive

Income

Balance as of September 25, 2009 $ 85 $(17) $68

Pre-tax current period change ........... 12 (1) 11

Balance as of September 24, 2010 97 (18) 79

Pre-tax current period change ........... 3 (5) (2)

Income tax benefit .................... — 2 2

Balance as of September 30, 2011 100 (21) 79

Pre-tax current period change ........... 17 (5) 12

Income tax benefit .................... — 2 2

Balance as of September 28, 2012 .......... $117 $(24) $93

(1) The balances of deferred pension losses as of September 28, 2012, September 30, 2011 and September 24,

2010 are reflected net of tax benefit of $15 million, $13 million and $11 million, respectively.

94