ADT 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with the issuance of the unsecured notes, the Company entered into an Exchange and

Registration Rights Agreement (the “Registration Rights Agreement”) with the initial purchasers of the notes,

dated July 5, 2012. Under the Registration Rights Agreement, the Company has agreed to (i) file with the

Securities and Exchange Commission a registration statement with respect to an exchange offer registered under

the Securities Act to exchange the notes of each series for an issue of another series of notes (the “Exchange

Notes”) that are identical in all material respects to the applicable series of notes (except that the Exchange Notes

will not contain transfer restrictions or any increase in annual interest rate) and (ii) to use commercially

reasonable efforts to cause the exchange offer registration statement to be declared effective under the Securities

Act within 365 days of July 5, 2012.

On September 12, 2012 the Company established a $750 million commercial paper program, supported by

its revolving credit facility of the same amount. As of September 28, 2012, the Company had no commercial

paper outstanding.

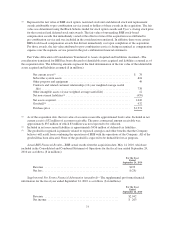

The fair value of the Company’s unsecured notes was determined using prices for similar securities obtained

from multiple external pricing services, which is considered a Level 2 input. The fair value of the Company’s

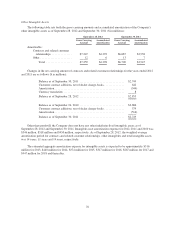

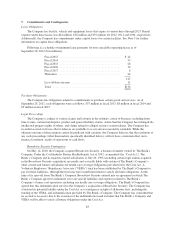

unsecured notes as of September 28, 2012 is as follows ($ in millions):

2.250% notes due July 2017 ............................ $ 766

3.500% notes due July 2022 ............................ 1,038

4.875% notes due July 2042 ............................ 798

Total .............................................. $2,602

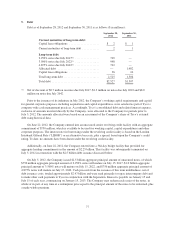

The fair value of the Company’s allocated debt, which was allocated in the same proportions as Tyco’s

external debt, was $1,717 million as of September 30, 2011.

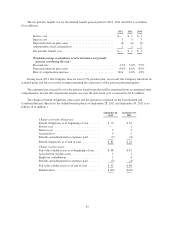

Interest expense totaled $93 million, $90 million and $107 million for the years ended September 28,

2012, September 30, 2011 and September 24, 2010, respectively. Interest expense for the first nine months of

fiscal year 2012, fiscal year 2011 and fiscal year 2010 includes allocated interest expense of $64 million, $87

million and $102 million, respectively. Interest expense for these periods was allocated in the same proportions

as debt and included the impact of Tyco’s interest rate swap agreements designated as fair value hedges. The

remaining amount of interest expense for fiscal year 2012 primarily represents interest incurred on the

Company’s unsecured notes. Cash paid for interest for fiscal years 2012, 2011 and 2010, which is presented in

the Consolidated and Combined Statements of Cash Flows, was allocated in the same proportions as Tyco’s

external debt.

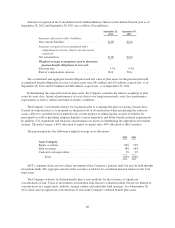

The Company’s revolving credit facility contains customary covenants, including a limit on the ratio of debt

to earnings before interest, taxes, depreciation, and amortization (“EBITDA”), a minimum required ratio of

EBITDA to interest expense and limits on incurrence of liens and subsidiary debt. In addition, the indenture

governing the Company’s senior unsecured notes contains customary covenants including limits on liens and

sale/leaseback transactions. Furthermore, acceleration of any obligation under any of the Company’s material

debt instruments will permit the holders of its other material debt to accelerate their obligations. As of

September 28, 2012, the Company was in compliance with all financial covenants on its revolving credit facility.

78