ADT 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pay Recoupment Policy

Our pay recoupment policy provides that, in addition to any other remedies available to it and subject to

applicable law, if our Board of Directors or any Committee of the Board determines that any annual or other

incentive payment, equity award or other compensation received by an executive officer resulted from any

financial result or operating metric that was impacted by the executive officer’s fraudulent or illegal conduct, the

Board or a Board Committee may recover from the executive officer that compensation it considers appropriate

under the circumstances. Our Board of Directors has the sole discretion to make any and all determinations under

this policy. We expect to update the pay recoupment policy when the regulations mandated by the Dodd-Frank

Act are implemented by the SEC.

Insider Trading Policy

The Company maintains an insider trading policy, applicable to all employees and directors. The policy

provides that the Company’s personnel may not buy, sell or engage in other transactions in the Company’s stock

while aware of material non-public information; buy or sell securities of other companies while aware of material

non-public information about those companies that they become aware of as a result of business dealings

between the Company and those companies; disclose material non-public information to any unauthorized

persons outside the Company; or engage in transactions in puts, calls, cashless collars, options or similar rights

and obligations involving the Company’s securities, other than the exercise of any Company-issued stock option.

The policy also restricts trading for a limited group of Company employees (including named executive officers

and directors) to defined window periods that follow our quarterly earnings releases.

Tax Deductibility of Executive Compensation

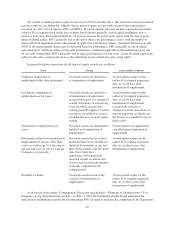

Section 162(m) of the Internal Revenue Code imposes a limit of $1.0 million on the amount of

compensation that can be deducted by ADT with respect to each of our named executive officers (other than

Ms. Mikells, our Chief Financial Officer), unless the compensation over $1.0 million qualifies as

“performance-based” under federal tax law. It is our policy to structure compensation arrangements with our

executive officers to qualify as performance-based so that compensation payments are deductible under U.S.

federal tax law, unless the benefit of such deductibility is outweighed by the need for flexibility or the attainment

of other corporate objectives. Potentially non-deductible forms of compensation include payments in connection

with the recruitment and retention of key employees, base salary over $1.0 million, discretionary bonus payments

and grants of time-based RSUs.

Compensation Committee Report on Executive Compensation

The Compensation Committee has reviewed and discussed with management this Compensation Discussion

and Analysis and, based on such review and discussions, has recommended to the Board of Directors that the

Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K and this

Proxy Statement.

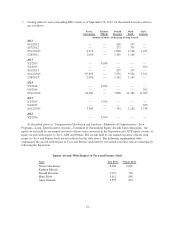

Submitted by the Compensation Committee of the Board of Directors:

Dinesh Paliwal, Chair

Timothy Donahue

Robert Dutkowsky

-44-