ADT 2012 Annual Report Download - page 123

Download and view the complete annual report

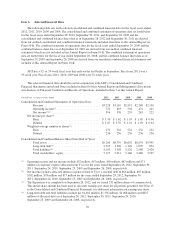

Please find page 123 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For additional information about our past financial performance and the basis of presentation of our

financial statements, see Management’s Discussion and Analysis of Financial Condition and Results of

Operations and our Consolidated and Combined Financial Statements.

As an independent, publicly-traded company, we may not enjoy the same benefits that we did as a

segment of Tyco.

There is a risk that, as a result of our separation from Tyco, we may become more susceptible to market

fluctuations and other adverse events than we would have been if we were still a part of the current Tyco

organizational structure. As part of Tyco, we enjoyed certain benefits from Tyco’s operating diversity,

purchasing power, available capital for investments and opportunities to pursue integrated strategies with Tyco’s

other businesses. As an independent, publicly-traded company, we do not have similar diversity or integration

opportunities and may not have similar purchasing power or access to capital markets.

As an independent, publicly-traded company, our capital structure and sources of liquidity will change

significantly from our capital structure as a segment of Tyco.

As an independent, publicly-traded company, we no longer participate in cash management and funding

arrangements with Tyco. Instead, our ability to fund our capital needs depends on our ongoing ability to generate

cash from operations, and to access our credit facilities and capital markets, which is subject to general

economic, financial, competitive, regulatory and other factors that are beyond our control.

Certain of the contracts transferred or assigned to us in connection with the Distribution contain

provisions requiring the consent of a third party in connection with the transactions contemplated by the

Distribution. If such consent is not given, we may not be entitled to the benefit of such contracts in the

future.

Certain of the contracts transferred or assigned to us in connection with the Distribution contain provisions

which require the consent of a third party to the internal transactions, the Distribution or both. If we are unable to

obtain such consents on commercially reasonable and satisfactory terms, our ability to obtain the benefit of such

contracts in the future may be impaired.

Our suppliers or other companies with whom we conduct business may need assurances that our

financial stability on a standalone basis is sufficient to satisfy their requirements for doing or continuing

to do business with them.

Some of our suppliers or other companies with whom we conduct business may need assurances that our

financial stability on a standalone basis is sufficient to satisfy their requirements for doing or continuing to do

business with them. Any failure of parties to be satisfied with our financial stability could have a material

adverse effect on our business, financial condition, results of operations and cash flows.

The ownership by our executive officers and some of our directors of common shares, options or other

equity awards of Tyco or Pentair may create, or may create the appearance of, conflicts of interest.

Because of their former positions with Tyco, substantially all of our executive officers, including our chief

executive officer and some of our non-employee directors, own common shares of Tyco and Pentair, options to

purchase common shares of Tyco and Pentair or other equity awards in Tyco and Pentair. The individual

holdings of common shares, options to purchase common shares or other equity awards of Tyco and Pentair may

be significant for some of these persons compared to their total assets. These equity interests may create, or

appear to create, conflicts of interest when these directors and officers are faced with decisions that could benefit

or affect the equity holders of Tyco or Pentair in ways that do not benefit or affect us in the same manner.

31