ADT 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To the extent ADT is responsible for any liability under the 2012 Tax Sharing Agreement, there could be a

material impact on its financial position, results of operations, cash flows or its effective tax rate in future

reporting periods.

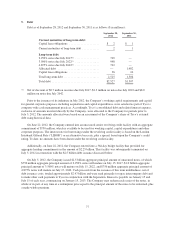

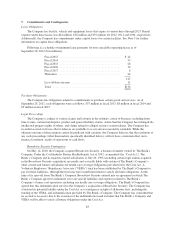

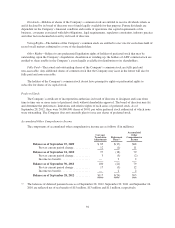

Other liabilities in the Company’s Consolidated and Combined Balance Sheet as of September 28, 2012

include $19 million for the fair value of ADT’s obligations under certain tax related agreements entered into in

conjunction with the Separation. The maximum amount of potential future payments is not determinable as they

relate to unknown conditions and future events that cannot be predicted.

8. Guarantees

In the normal course of business, the Company is liable for contract completion and product performance. In

the opinion of management, such obligations will not significantly affect the Company’s financial position,

results of operations or cash flows.

As of September 28, 2012, the Company had no outstanding letters of credit; however, letters of credit may

be issued in the future in connection with routine business requirements.

9. Related Party Transactions

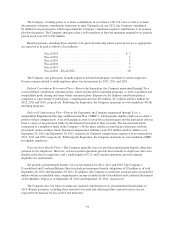

Transaction with Directors—Certain members of the Company’s board of directors also served on Tyco’s

board of directors prior to the Separation. Transactions with Tyco during fiscal years 2012, 2011 and 2010 are

described below. Additionally, during fiscal 2012, 2011 and 2010, the Company engaged in commercial

transactions in the normal course of business with companies where Directors of ADT or Tyco were employed

and served as officers. During each of these periods, the Company’s purchases from such companies aggregated

less than 1 percent of combined revenue.

Cash Management—Prior to the Separation, the Company’s cash was regularly “swept” by Tyco at its

discretion in conjunction with its centralized approach to cash management and financing of operations.

Transfers of cash both to and from Tyco are included within parent company investment on the Consolidated and

Combined Statements of Stockholders’ Equity. The main components of transfers to and from Tyco are related to

cash pooling and general financing activities as well as cash transfers for acquisitions, investments and various

allocations from Tyco.

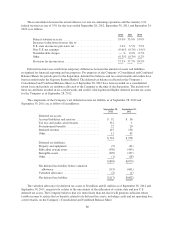

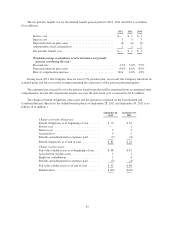

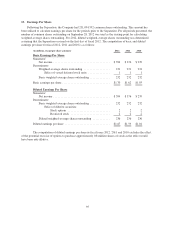

Trade Activity—Accounts payable includes $14 million and $9 million of payables to Tyco affiliates as of

September 28, 2012 and September 30, 2011, respectively, primarily related to the purchase of inventory. During

fiscal 2012, 2011 and 2010, the Company purchased inventory from Tyco affiliates in the amount of $110

million, $79 million and $34 million, respectively.

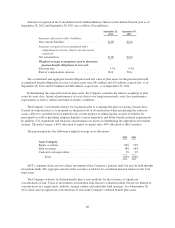

Service and Lending Arrangement with Tyco Affiliates—Prior to the Separation, the Company had various

debt and cash pool agreements with Tyco affiliates, which were executed outside of the normal Tyco centralized

approach to cash management and financing of operations. Other liabilities as of September 30, 2011 includes

$63 million of payables to Tyco affiliates related to these types of transactions.

Also, prior to the Separation, the Company, Tyco and its affiliates paid for expenses on behalf of each other.

Prepaid expenses and other current assets includes $7 million of receivables from Tyco and its affiliates as of

September 30, 2011. Accrued and other current liabilities includes $2 million of payables to Tyco and its

affiliates as of September 30, 2011.

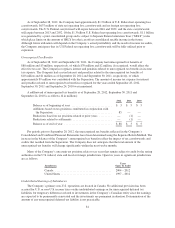

Debt and Related Items—For periods prior to the Separation, the Company was allocated a portion of

Tyco’s consolidated debt and interest expense. Note 5 provides further information regarding these allocations.

85