ADT 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity

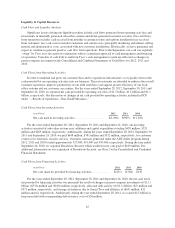

At September 28, 2012, we had approximately $234 million in cash and equivalents. Additionally, on

September 12, 2012, we established a $750 million commercial paper program. This commercial paper program

is supported by our revolving credit facility, which is discussed further below. As of September 28, 2012, we had

no commercial paper outstanding and had no borrowings under our revolving credit facility. In accordance with

the Separation and Distribution Agreement between Tyco and ADT, additional cash may be transferred between

the companies after the Separation related to the final allocation of funds between the companies. We are not

currently able to estimate the amount of this final allocation. Our primary future cash needs are centered on

operating activities, working capital, capital expenditures and strategic investments. We believe our cash

position, amounts available under our revolving credit facility and cash provided by operating activities will be

adequate to cover our operational and business needs in the foreseeable future.

On June 22, 2012, we entered into a $750 million five-year unsecured senior revolving credit facility. The

interest rate for borrowings under the new credit facility is based on the London Interbank Offered Rate

(“LIBOR”) or, at our option, an alternative base rate, plus a spread, based upon our credit rating. The credit

facility is available to use for working capital, capital expenditures and other general corporate purposes.

Pursuant to the terms of our credit facility, we must maintain a ratio of consolidated total debt to consolidated

EBITDA on a rolling four quarter basis of no greater than 3.50 to 1.00 and a ratio of consolidated EBITDA to

consolidated interest expense of no less than 3.00 to 1.00 as measured on a rolling four quarter basis.

On July 5, 2012, we issued $750 million aggregate principal amount of 2.250% unsecured notes due

July 15, 2017, $1.0 billion aggregate principal amount of 3.500% unsecured notes due July 15, 2022, and $750

million aggregate principal amount of 4.875% unsecured notes due July 15, 2042. Net cash proceeds from the

issuance of this term indebtedness totaled approximately $2.47 billion and were used to repay intercompany debt

and to make other cash payments to Tyco to allow it to fund repurchases or redemptions of its indebtedness.

On November 26, 2012, our board of directors approved $2 billion of share repurchases over the next three

years.

Dividends

On November 26, 2012, our board of directors declared a quarterly dividend on our common shares of

$0.125 per share. This dividend will be paid on December 18, 2012 to shareholders of record on December 10,

2012. We currently anticipate that all of the dividend is likely to represent a return of capital to our shareholders.

Whether our board of directors exercises its discretion to approve any dividends in the future will depend on

many factors, including our financial condition, capital requirements of our business, covenants associated with

debt obligations, legal requirements, regulatory constraints, industry practice and other factors that our board of

directors deems relevant. Therefore, we can make no assurance that we will pay a dividend in the future.

46