ADT 2012 Annual Report Download - page 131

Download and view the complete annual report

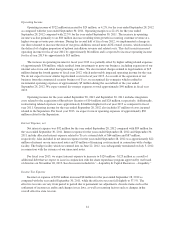

Please find page 131 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Customer Attrition Rate. Our economic model is highly dependent on customer retention. Success in retaining

customers is driven in part by our discipline in accepting new customers with favorable characteristics and by

providing high quality equipment, installation, monitoring and customer service. We evaluate our customer

retention based upon the recurring revenue lost resulting from customer attrition, net of dealer charge-backs and

re-sales. Dealer charge-backs represent customer cancellations charged back to the dealers because the customer

cancelled service during the initial period of the contract, generally 12 to 15 months. Re-sales are inactive

customer sites that are returned to active service during the period. The attrition rate is a 52 week trailing ratio,

the numerator of which is the annualized recurring revenue lost during the period due to attrition and the

denominator of which is total annualized recurring revenue based on an average of recurring revenue under

contract at the beginning of each month during the period.

Recurring Customer Revenue. Recurring customer revenue is generated by contractual monthly recurring fees for

monitoring and other recurring services provided to our customers. For fiscal year 2012, recurring customer

revenue represented approximately 90% of total revenue. Our other revenue, which represented the remaining

10% of total revenue in fiscal year 2012, consists of revenue associated with sale of equipment, deferred revenue

related to upfront installations fees, non-routine repair and maintenance services and customer termination

charges.

Average Revenue per Customer. Average revenue per customer measures the average amount of recurring

revenue per customer per month, and is calculated based on the recurring revenue under contract at the end of the

period, divided by the total number of customers under contract at the end of the period.

Earnings before interest, taxes, depreciation and amortization (“EBITDA”). EBITDA is a non-GAAP measure

reflecting net income adjusted for interest, taxes and certain non-cash items which include depreciation of

subscriber system assets and other fixed assets, amortization of deferred costs and deferred revenue associated

with customer acquisitions, and amortization of dealer and other intangible assets. We believe EBITDA is useful

to provide investors with information about operating profits, adjusted for significant non-cash items, generated

from the existing customer base. A reconciliation of EBITDA to net income (the most comparable GAAP

measure) is provided under “—Results of Operations—Non-GAAP Measures.”

Free Cash Flow (“FCF”). FCF is a non-GAAP measure that our management employs to measure cash that is

free from any significant existing obligation and is available to service debt and make investments. The

difference between net cash provided by operating activities (the most comparable GAAP measure) and FCF is

cash outlays for capital expenditures, subscriber system assets, dealer generated customer accounts and bulk

account purchases. A reconciliation of FCF to net cash provided by operating activities is provided under

“—Results of Operations—Non-GAAP Measures.”

39