ADT 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “ADT”. As of

the close of business on November 16, 2012, there were 21,332 holders of record of our common stock. High and

low sales prices per share of our common stock as reported by the NYSE for each full quarterly period of fiscal

years 2012 and 2011 are not provided as ADT common shares did not begin “regular way” trading on the NYSE

until October 1, 2012.

Dividends

We intend to pay an annual dividend of approximately $0.50 per common share in four quarterly

installments. The timing, declaration and payment of future dividends to holders of our common stock fall within

the discretion of our board of directors and will depend on our financial condition and results of operations, the

capital requirements of our business, covenants associated with debt obligations, legal requirements, regulatory

constraints, industry practice and other factors deemed relevant by our board of directors.

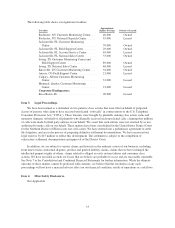

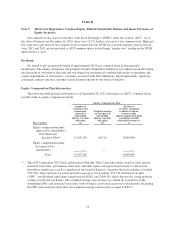

Equity Compensation Plan Information

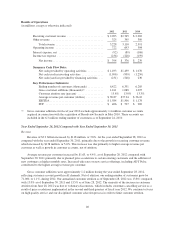

The following table provides information as of September 28, 2012 with respect to ADT’s common shares

issuable under its equity compensation plans:

Equity Compensation Plan

Plan Category

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

(a)

Weighted-average

exercise price of

outstanding

options, warrants

and rights

(b)

Number of

securities remaining

available for future

issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

Equity compensation plans

approved by shareholders:

2012 Stock and

Incentive Plan(1) .... 11,007,182 $19.20 8,000,000

Equity compensation plans

not approved by

shareholders ........... — — —

Total ........... 11,007,182 8,000,000

(1) The ADT Corporation 2012 Stock and Incentive Plan (the “Plan”) provides for the award of stock options,

restricted stock units, performance share units and other equity and equity-based awards to officers and

non-officer employees as well as members of our board of directors. Amounts shown in column (a) include

7,837,941 shares that may be issued upon the exercise of stock options, 559,722 deferred stock units

(“DSU”) and dividend equivalents earned on such DSUs, and 2,609,519 shares that may be issued upon the

vesting of restricted stock units. The weighted-average exercise price in column (b) is inclusive of the

outstanding DSUs and restricted stock units, both of which can be exercised for no consideration. Excluding

the DSUs and restricted stock units, the weighted-average exercise price is equal to $26.97.

34