ADT 2012 Annual Report Download - page 178

Download and view the complete annual report

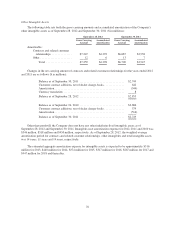

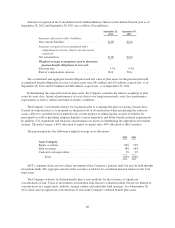

Please find page 178 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Insurable Liabilities—For fiscal years 2010 through 2012, the Company was insured for product liability,

worker’s compensation, property, general and auto liabilities by a captive insurance company that is wholly-

owned by Tyco. The Company paid a premium in each year to obtain insurance coverage during these periods.

Premiums expensed by the Company were $24 million, $24 million and $18 million in 2012, 2011 and 2010,

respectively, and are included in the selling, general and administrative expenses in the Consolidated and

Combined Statements of Operations.

As of September 28, 2012 and September 30, 2011, the Company recorded insurance-related liabilities in

the Consolidated and Combined Balance Sheets of $47 million and $57 million, respectively. Due to the fact that

Tyco has retained the liability associated with claims incurred prior to the Separation, the Company has recorded

insurance receivables offsetting its liabilities related to these claims. As of September 28, 2012 and

September 30, 2011, the current portion of these insurance receivables, which totaled $11 million and $14

million, respectively, is reflected in prepaid and other current assets in the Consolidated and Combined Balance

Sheets. The non-current portion of these receivables is reflected in other assets.

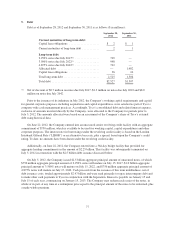

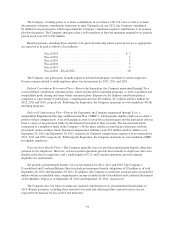

General Corporate Overhead—For fiscal 2010 through fiscal 2012, the Company was allocated corporate

overhead expenses from Tyco for corporate related functions based on the relative proportion of either the

Company’s headcount or revenue to Tyco’s consolidated headcount or revenue. Corporate overhead expenses

primarily related to centralized corporate functions, including finance, treasury, tax, legal, information

technology, internal audit, human resources and risk management functions. During fiscal 2012, 2011 and 2010,

the Company was allocated $52 million, $67 million and $69 million, respectively, of general corporate expenses

incurred by Tyco which are included within selling, general and administrative expenses in the Consolidated and

Combined Statements of Operations. Further discussion of allocations is included in Note 1.

Separation and Distribution Agreements—In conjunction with the Separation, the Company entered into

Separation and Distribution Agreements and other agreements with Tyco and Pentair, which govern the

relationships among the Company, Tyco and Pentair subsequent to the Separation. The Separation and

Distribution Agreement between ADT and Tyco provided for the allocation to ADT of certain of Tyco’s assets,

liabilities and obligations attributable to periods prior to the Separation, which is reflected in the Company’s

Consolidated and Combined Balance Sheet as of September 28, 2012. This agreement also provides for certain

non-compete and non-solicitation restrictions that prohibit the Company from competing with Tyco in the

commercial security market in the United States and Canada for a period of time after the Separation.

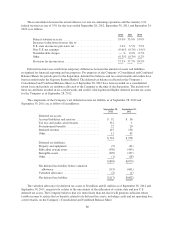

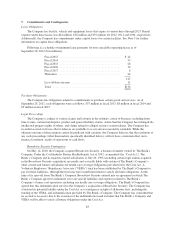

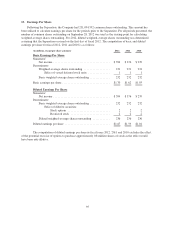

10. Retirement Plans

The Company measures its retirement plans as of its fiscal year end.

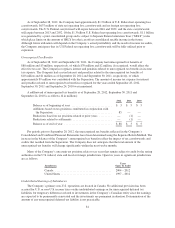

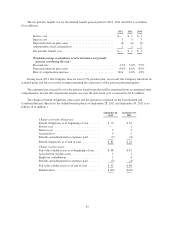

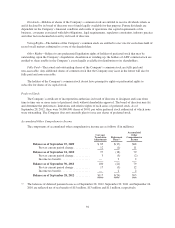

Defined Benefit Pension Plan—The Company sponsors one noncontributory defined benefit retirement plan

covering certain of its U.S. employees. Net periodic pension benefit cost is based on periodic actuarial valuations

which use the projected unit credit method of calculation and is charged to the Consolidated and Combined

Statements of Operations on a systematic basis over the expected average remaining service lives of current

participants. Contribution amounts are determined based on U.S. regulations and the advice of professionally

qualified actuaries. The benefits under the defined benefit plan are based on various factors, such as years of

service and compensation.

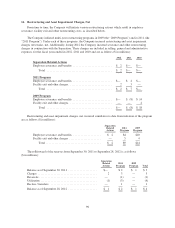

Prior to the Separation, the plan was a co-mingled plan and included plan participants of other Tyco

subsidiaries. Therefore, for periods prior to September 28, 2012, the Company recorded its portion of the

co-mingled plan expense and the related obligations, which had been actuarially determined based on the

Company’s specific benefit formula by participant and allocated plan assets. The contribution amounts for

periods prior to the Separation were determined in total for the co-mingled plan and allocated to the Company

based on headcount. In conjunction with the Separation, the plan was legally separated, and assets were

reallocated based on the ERISA prescribed calculation.

86