ADT 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

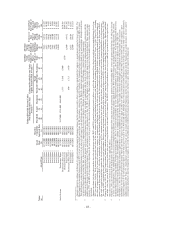

maximum potential performance share value by individual for fiscal year 2012: Mr. Gursahaney—$1,779,005; Mr. Boerema—$188,772;

Mr. Edoff—$302,431; Ms. Graham—$340,976. Information regarding the assumptions used to determine fair value appears in Note 12

(“Share Plans”) to our combined financial statements for fiscal year 2012. Ms. Mikells did not receive PSUs in fiscal year 2012.

Amounts in column (e) for fiscal year 2012 include the incremental fair value associated with the shortening of the performance period for

outstanding PSUs. The shortening of the performance period was associated with ADT’s separation from Tyco. Amounts in column (f) for

fiscal year 2012 include the incremental fair value associated with the conversion of outstanding Tyco stock options into stock options of

ADT. On July 12, 2012, in connection with the 2012 Separation, the Tyco Board of Directors approved the conversion of all outstanding

Tyco PSUs into RSUs based on performance achieved through June 29, 2012. On August 2, 2012, the Tyco Compensation Committee

approved the conversion ratio based on its review and certification of performance results. On October 12, 2011 the Tyco Compensation

Committee approved the methodology that would apply to convert outstanding Tyco equity awards upon completion of the Separation into

post-Separation equity awards of ADT, or split into equity awards of Tyco, ADT and Pentair, in order to preserve intrinsic value. These

conversions are discussed in further detail above under the heading “Compensation Discussion and Analysis—Elements of

Compensation—Long-Term Incentive Awards—Tyco Programs—Treatment of Outstanding Equity Awards Upon Separation.”

(5) Non-Equity Incentive Plan Compensation: The amounts reported in column (g) for each named executive officer reflect annual cash

incentive compensation for the applicable fiscal year. Annual incentive compensation is discussed in further detail above under the

heading “Compensation Discussion and Analysis—Elements of Compensation—Tyco Programs—Annual Incentive Compensation.”

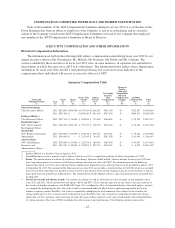

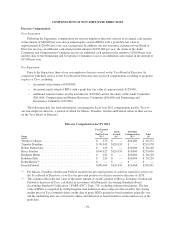

(6) All Other Compensation: The amounts reported in column (i) for each named executive officer represent cash perquisites, insurance

premiums paid by Tyco for the benefit of the officer (and, in some cases, the officer’s spouse), Tyco’s contributions to 401(k) plans and

non-qualified plans of Tyco and its subsidiaries providing similar benefits, and other miscellaneous benefits. The components of All

Other Compensation for each named executive officer are shown in the following table.

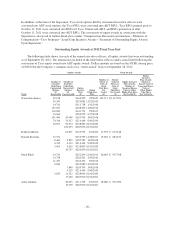

Supplemental Executive Insurance Benefits

Named Executive

Fiscal

Year

Cash

Perquisite

Variable

Universal Life

Supplemental

Disability

Long-Term

Care

Tax Gross-

Ups

Retirement Plan

Contributions Miscellaneous

Total All Other

Compensation

Current Officers

Naren Gursahaney 2012 $15,250 $10,019 $15,008 $19,274 — $70,225 $23,091 $152,957

2011 $59,750 $10,019 $15,008 $19,275 — $86,665 $ 9,614 $200,421

Kathryn Mikells 2012 — — — — — $ 7,395 $ 5,000 $ 12,395

Donald Boerema 2012 $ 8,009 — — — — $23,517 $ 5,000 $ 36,526

Mark Edoff 2012 $ 8,500 — — — — $28,726 $ 2,000 $ 39,226

2011 $34,000 — — — — $27,928 $ 35 $ 61,963

Anita Graham 2012 — — — — $5,877 $35,091 $23,119 $ 64,087

2011 — — — — — $ 6,305 — $ 6,305

(a) Cash Perquisites reflect an annual cash perquisite payment equal to the lesser of 10% of the executive’s base salary and $70,000.

Payments are made quarterly and are adjusted to reflect changes in salary. This benefit was discontinued by Tyco as of January 1, 2012.

(b) Supplemental Executive Insurance Benefits reflect premiums paid by Tyco for insurance benefits for the executive and, in the case of

long-term care, for the executive’s spouse as well. These benefits were provided to certain executives of Tyco upon the approval of the

Tyco Compensation Committee. Mr. Gursahaney was the only one of our named executive officers who received these benefits in his

role as an executive of Tyco. ADT has discontinued this benefit for Mr. Gursahaney as of November 30, 2012.

(c) The amount shown in this column as tax gross-up payments for Ms. Graham for fiscal year 2012 represents tax gross-up payments made

with respect to taxable relocation expenses.

(d) Retirement plan contributions include matching contributions made by Tyco on behalf of each executive to its tax-qualified 401(k)

Retirement, Savings and Investment Plan and to its non-qualified Supplemental Savings and Retirement Plan.

(e) Miscellaneous compensation in fiscal year 2012 includes matching charitable contributions Tyco made on behalf of Messrs. Gursahaney,

Boerema and Edoff, the value of relocation benefits for Mr. Gursahaney, Ms. Mikells and Ms. Graham, as well as the value of an

executive physical for Ms. Graham. In fiscal year 2011, miscellaneous compensation for Mr. Gursahaney includes matching charitable

contributions Tyco made on his behalf as well as de minimis payments made for the vesting of fractional shares. De minimis payments

made for the vesting of fractional shares are also included in miscellaneous compensation for Mr. Edoff in fiscal year 2011.

-46-