ADT 2012 Annual Report Download - page 163

Download and view the complete annual report

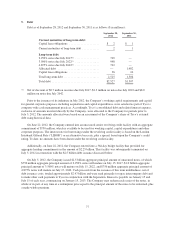

Please find page 163 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In September 2011, the FASB issued authoritative guidance which amends the process of testing goodwill

for impairment. The guidance permits an entity to first assess qualitative factors to determine whether the

existence of events or circumstances leads to a determination that it is more likely than not (defined as having a

likelihood of more than fifty percent) that the fair value of a reporting unit is less than its carrying amount. If an

entity determines it is not more likely than not that the fair value of a reporting unit is less than its carrying

amount, performing the traditional two step goodwill impairment test is unnecessary. If an entity concludes

otherwise, it would be required to perform the first step of the two step goodwill impairment test. If the carrying

amount of the reporting unit exceeds its fair value, then the entity is required to perform the second step of the

goodwill impairment test. However, an entity has the option to bypass the qualitative assessment in any period

and proceed directly to step one of the impairment test. The guidance is effective for the Company for interim

and annual impairment testing beginning in the first quarter of fiscal year 2013.

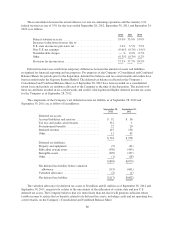

In July 2012, the FASB issued authoritative guidance which amends the process of testing indefinite-lived

intangible assets for impairment. This guidance permits an entity to first assess qualitative factors to determine

whether the existence of events or circumstances leads to a determination that it is more likely than not (defined

as having a likelihood of more than fifty percent) that the indefinite-lived intangible asset is impaired. If an entity

determines it is not more likely than not that the indefinite-lived intangible asset is impaired, the entity will have

an option not to calculate the fair value of an indefinite-lived asset annually. The guidance is effective for the

Company for interim and annual impairment testing beginning in the first quarter of fiscal year 2013.

2. Acquisitions

Dealer Generated Customer Accounts and Bulk Account Purchases

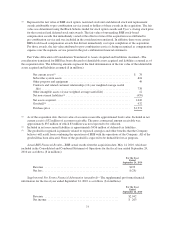

During fiscal years 2012, 2011 and 2010, the Company paid $648 million, $581 million and $532 million,

respectively, for customer contracts for electronic security services. Customer contracts generated under the ADT

dealer program during 2012, 2011 and 2010 totaled approximately 527,000, 491,000 and 459,000, respectively.

Acquisitions

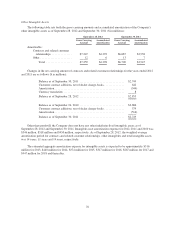

During the year ended September 24, 2010, cash paid for acquisitions totaled $449 million, net of cash

acquired of $136 million, which related to the acquisition of Brink’s Home Security Holdings, Inc (“BHS” or

“Broadview Security”), which is further described below. During the years ended September 28, 2012 and

September 30, 2011, there were no acquisitions made by the Company.

Acquisition of Broadview Security

On May 14, 2010, the Company acquired all of the outstanding equity of Broadview Security, a publicly

traded company that was formerly owned by The Brink’s Company, in a cash-and-stock transaction valued at

approximately $2.0 billion. Prior to its acquisition, Broadview Security’s core business was to provide security

alarm monitoring services for residential and small business properties in North America. Under the terms of the

transaction, each outstanding share of BHS common stock was converted into the right to receive: (1) $13.15 in

cash and 0.7562 Tyco common shares, for those shareholders who made an all-cash election, (2) 1.0951 Tyco

common shares, for those shareholders who made an all stock election or (3) $12.75 in cash and 0.7666 Tyco

common shares, for those shareholders who made a mixed cash/stock election or who failed to make an election.

71