ADT 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

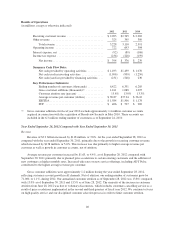

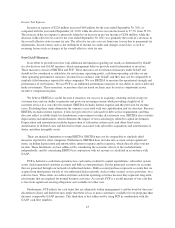

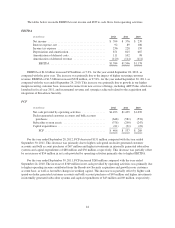

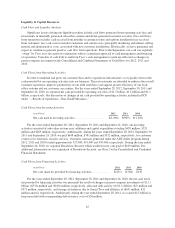

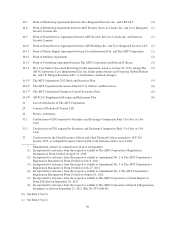

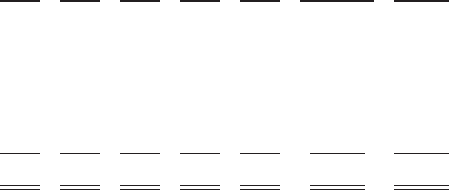

Commitments and Contractual Obligations

The following table provides a summary of our contractual obligations and commitments for debt, minimum

lease payment obligations under non-cancelable leases and other obligations as of September 28, 2012.

(in millions) 2013 2014 2015 2016 2017 Thereafter Total

Debt principal(1) ............................... $— $— $— $— $750 $1,750 $2,500

Interest payments(2) ............................ 92 90 90 90 89 1,089 1,540

Operating leases ............................... 44 33 26 12 6 24 145

Capital leases .................................66666 27 57

Purchase obligations(3) .......................... 37 8 5 — — — 50

Minimum required pension plan contributions(4) ..... 2 ———— — 2

Total contractual cash obligations(5) ............... $181 $137 $127 $108 $851 $2,890 $4,294

(1) Excludes debt discount and interest.

(2) Interest payments consist primarily of interest on our fixed-rate debt.

(3) Purchase obligations consist of commitments for purchases of goods and services.

(4) We have net unfunded pension and postretirement benefit obligations of $29 million and $5 million,

respectively, to certain employees and former employees as of the year ended September 28, 2012. We are

obligated to make contributions to our pension plans and postretirement benefit plans; however, we are

unable to determine the amount of plan contributions due to the inherent uncertainties of obligations of this

type, including timing, interest rate changes, investment performance, and amounts of benefit payments.

The minimum required contributions to our pension plans are expected to be approximately $2 million in

fiscal year 2013. These plans and our estimates of future contributions and benefit payments are more fully

described in Note 10 to the Consolidated and Combined Financial Statements.

(5) Total contractual cash obligations in the table above exclude income taxes as we are unable to make a

reasonably reliable estimate of the timing for the remaining payments in future years. See Note 6 to the

Consolidated and Combined Financial Statements for further information.

As of September 28, 2012, we had no outstanding letters of credit; however, we may issue letters of credit in

the future in connection with routine business requirements.

Off-Balance Sheet Arrangements

As of September 28, 2012, we had no off-balance sheet arrangements.

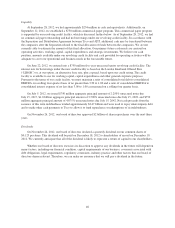

Critical Accounting Policies & Estimates

The preparation of the Consolidated and Combined Financial Statements in conformity with U.S. GAAP

requires management to use judgment in making estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenue and

expenses. The following accounting policies are based on, among other things, judgments and assumptions made

by management that include inherent risks and uncertainties. Management’s estimates are based on the relevant

information available at the end of each period.

Revenue Recognition

Major components of our revenue include contractual monitoring and maintenance service revenue,

non-refundable installation fees related to subscriber system assets, sales of equipment and other services. We

follow the authoritative literature on revenue recognition, which requires us to defer certain revenue associated

with customer acquisition.

47