ADT 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

equal to the fair market value of our common stock on the date of grant. PSUs will vest in full on the third

anniversary of the date of grant, with the number of PSUs to be delivered based on achieving performance goals

with respect to recurring revenue growth (60% weighting) and adjusted free cash flow (as defined above) growth

(40% weighting). In order to place more emphasis on performance-based compensation, Mr. Gursahaney did not

receive an annual grant of RSUs, and was instead granted only stock options (50%) and PSUs (50%).

Also, in connection with the Separation, our Compensation Committee made additional one-time equity

grants to certain of our key employees, including each of our named executive officers, to further align the

interests of these key employees with the interests of our stockholders. These one-time Founders’ Grants are

intended to enhance retention of our new management team, and are not considered part of our regular executive

compensation program. The Founders’ Grants were in the form of stock options (50%) and RSUs (50%). These

one-time stock option awards will vest in three equal installments on each of the first three anniversaries of the

date of grant. The one-time RSU awards will vest in full on the third anniversary of the date of grant.

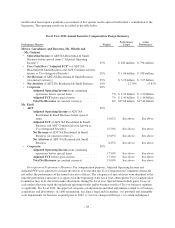

The following table summarizes the grant date value or the target value, as applicable, for each form of

award for both the annual equity grants and the Founders’ Grants for each of our named executive officers:

Fiscal Year 2013 Long-Term Equity Incentive Awards

Annual Equity Award Grants

One-Time Founders

Grants

TotalNamed Executive Officer Options RSUs PSUs Options RSUs

Naren Gursahaney $1,750,000 — $1,750,000 $875,000 $875,000 $5,250,000

Kathryn Mikells $ 520,000 $260,000 $ 520,000 $325,000 $325,000 $1,950,000

Donald Boerema $ 140,000 $ 70,000 $ 140,000 $ 87,500 $ 87,500 $ 525,000

Mark Edoff $ 140,000 $ 70,000 $ 140,000 $ 87,500 $ 87,500 $ 525,000

Anita Graham $ 200,000 $100,000 $ 200,000 $125,000 $125,000 $ 750,000

Executive Benefit Plans and Other Elements of Compensation

Our named executive officers are eligible to participate in the benefit plans that are available to substantially all

of our U.S. employees, including our 401(k) plan and our medical insurance, dental insurance, life insurance and

long-term disability plans. None of our named executive officers participate in a defined benefit pension plan.

Our named executive officers are also eligible to participate in the Company’s Supplemental Savings and

Retirement Plan (the “SSRP”), which is a deferred compensation plan that permits the elective deferral of base

salary and annual performance-based bonus for executives earning more than $115,000 per year. The SSRP

provides executives with the opportunity to:

• contribute retirement savings in addition to amounts permitted under the Company’s tax qualified

401(k) Retirement Savings and Investment Plan (“RSIP”);

• defer compensation on a tax-deferred basis and receive tax-deferred market-based growth; and

• receive any Company contributions that were reduced under the RSIP due to IRS compensation limits.

Supplemental Insurance Benefits. Following the Separation, Mr. Gursahaney continued to receive the

supplemental insurance benefits that he received from Tyco prior to the Spin-off under policies whose premiums

had been paid by Tyco. Going forward, our Compensation Committee decided to end the supplemental insurance

benefit program for Mr. Gursahaney. In connection with the discontinuance of these benefits, we made a one-

time grant of RSUs to Mr. Gursahaney in November 2012, with a grant date fair value equal to two times the

annual premium value of these benefits and a pro-rata vesting schedule of two years.

Executive Physical Program. The Company strongly believes in investing in the health and well-being of its

executives as an important component in providing continued effective leadership for the Company. As such, we

have adopted an annual executive physical program. All of our named executive officers are eligible for this benefit.

-33-