ADT 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

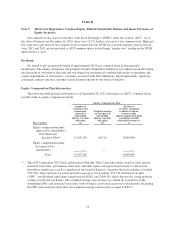

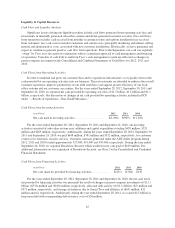

The tables below reconcile EBITDA to net income and FCF to cash flows from operating activities.

EBITDA

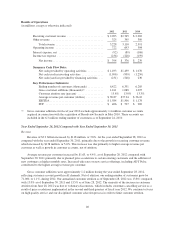

(in millions) 2012 2011 2010

Net income ........................................ $ 394 $ 376 $ 239

Interest expense, net ................................. 92 89 106

Income tax expense ................................. 236 228 159

Depreciation and amortization ......................... 871 825 687

Amortization of deferred costs ......................... 111 102 98

Amortization of deferred revenue ...................... (120) (114) (111)

EBITDA ...................................... $1,584 $1,506 $1,178

EBITDA of $1.6 billion increased $78 million, or 5.2%, for the year ended September 28, 2012, as

compared with the prior year. The increase was primarily due to the impact of higher recurring customer

revenue. EBITDA of $1.5 billion increased $328 million, or 27.8%, for the year ended September 30, 2011, as

compared with the year ended September 24, 2010. This increase was primarily due to growth in our higher

margin recurring customer base, increased revenue from new service offerings, including ADT Pulse, which we

launched in fiscal year 2011, and incremental revenue and synergies achieved related to the acquisition and

integration of Broadview Security.

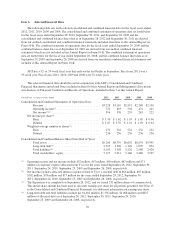

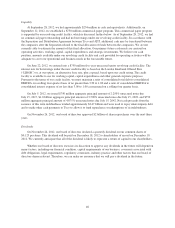

FCF

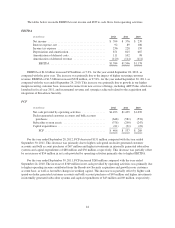

(in millions) 2012 2011 2010

Net cash provided by operating activities ................ $1,493 $1,439 $1,070

Dealer generated customer accounts and bulk account

purchases ....................................... (648) (581) (532)

Subscriber system assets ............................. (378) (290) (247)

Capital expenditures ................................. (61) (31) (22)

FCF.......................................... $ 406 $ 537 $ 269

For the year ended September 28, 2012, FCF decreased $131 million compared with the year ended

September 30, 2011. This decrease was primarily due to higher cash spend on dealer generated customer

accounts and bulk account purchases of $67 million and higher investments in internally generated subscriber

systems and capital expenditures of $88 million and $30 million, respectively. This decrease was partially offset

by an increase of $54 million in net cash provided by operating activities primarily due to higher EBITDA.

For the year ended September 30, 2011, FCF increased $268 million compared with the year ended

September 24, 2010. The increase of $369 million in net cash provided by operating activities was primarily due

to higher operating income contributed from the Broadview Security acquisition and growth in our customer

account base, as well as favorable changes in working capital. This increase was partially offset by higher cash

spend on dealer generated customer accounts and bulk account purchases of $49 million and higher investments

in internally generated subscriber systems and capital expenditures of $43 million and $9 million, respectively.

44