ADT 2012 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

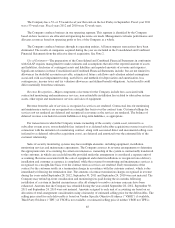

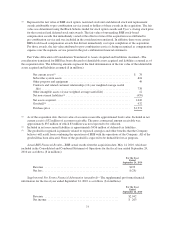

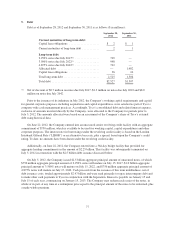

3. Property and Equipment

Property and equipment consisted of the following ($ in millions):

September 28,

2012

September 30,

2011

Land ............................................. $ 9 $ 9

Buildings and leasehold improvements .................. 76 64

Machinery and equipment ............................ 369 290

Property under capital leases(1) ......................... 43 25

Construction in progress ............................. 34 37

Accumulated depreciation(2) ........................... (314) (253)

Property and equipment, net ...................... $217 $172

(1) Property under capital leases consists primarily of buildings.

(2) Accumulated amortization of capital lease assets was $25 million and $13 million as of September 28, 2012

and September 30, 2011, respectively.

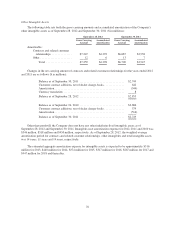

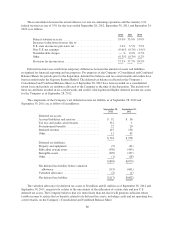

4. Goodwill and Other Intangible Assets

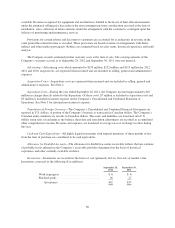

Goodwill

Annually, in the fiscal fourth quarter, and more frequently if events or changes in business circumstances

indicate that it is more likely than not that the carrying value of a reporting unit exceeds its fair value, the

Company tests goodwill for impairment by comparing the fair value of the Company’s reporting unit with its

carrying amount. Fair value of the Company’s reporting unit is determined utilizing a discounted cash flow

analysis based on the Company’s forecast cash flows discounted using an estimated weighted-average cost of

capital of market participants. If the carrying amount of the reporting unit exceeds its fair value, goodwill is

considered potentially impaired. In determining fair value, management relies on and considers a number of

factors, including operating results, business plans, economic projections, anticipated future cash flows and other

market data. There were no goodwill impairments as a result of performing the Company’s 2012, 2011 and 2010

annual impairment tests.

The changes in the carrying amount of goodwill for the years ended 2012 and 2011 are as follows

($ in millions):

Balance as of September 30, 2011 ............................... $3,395

Currency translation .......................................... 5

Balance as of September 28, 2012 ............................... $3,400

Balance as of September 24, 2010 ............................... $3,393

Acquisitions/purchase accounting adjustments ..................... 2

Balance as of September 30, 2011 ............................... $3,395

75