ADT 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

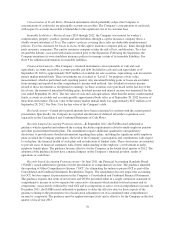

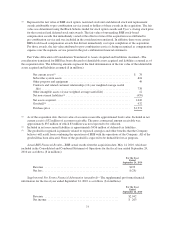

5. Debt

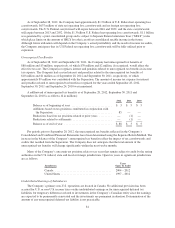

Debt as of September 28, 2012 and September 30, 2011 is as follows ($ in millions):

September 28,

2012

September 30,

2011

Current maturities of long-term debt:

Capital lease obligations ..................... $ 2 $ 1

Current maturities of long-term debt ............ 2 1

Long-term debt:

2.250% notes due July 2017(1) ................. 749 —

3.500% notes due July 2022(1) ................. 998 —

4.875% notes due July 2042(1) ................. 742 —

Allocated debt ............................. — 1,482

Capital lease obligations ..................... 36 24

Total long-term debt ......................... 2,525 1,506

Total debt ................................. $2,527 $1,507

(1) Net of discount of $0.7 million on notes due July 2017, $2.3 million on notes due July 2022 and $8.0

million on notes due July 2042.

Prior to the issuance of its indenture in July 2012, the Company’s working capital requirements and capital

for general corporate purposes, including acquisitions and capital expenditures, were satisfied as part of Tyco’s

company-wide cash management practices. Accordingly, Tyco’s consolidated debt and related interest expense,

exclusive of amounts incurred directly by the Company, were allocated to the Company for periods prior to

July 5, 2012. The amounts allocated were based on an assessment of the Company’s share of Tyco’s external

debt using historical data.

On June 22, 2012, the Company entered into an unsecured senior revolving credit facility with an aggregate

commitment of $750 million, which is available to be used for working capital, capital expenditures and other

corporate purposes. The interest rate for borrowings under the revolving credit facility is based on the London

Interbank Offered Rate (“LIBOR”) or an alternative base rate, plus a spread, based upon the Company’s credit

rating. To date, no amounts have been drawn under the revolving credit facility.

Additionally, on June 22, 2012, the Company entered into a 364-day bridge facility that provided for

aggregate lending commitments in the amount of $2.25 billion. This facility was subsequently terminated on

July 5, 2012 in connection with the $2.5 billion debt issuance discussed below.

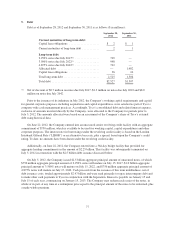

On July 5, 2012, the Company issued $2.5 billion aggregate principal amount of unsecured notes, of which

$750 million aggregate principal amount of 2.250% notes will mature on July 15, 2017, $1.0 billion aggregate

principal amount of 3.500% notes will mature on July 15, 2022, and $750 million aggregate principal amount of

4.875% notes will mature on July 15, 2042. Cash proceeds from the issuance of this term indebtedness, net of

debt issuance costs, totaled approximately $2.47 billion and were used primarily to repay intercompany debt and

to make other cash payments to Tyco in conjunction with the Separation. Interest is payable on January 15 and

July 15 of each year, commencing on January 15, 2013. The Company may redeem each series of the notes, in

whole or in part, at any time at a redemption price equal to the principal amount of the notes to be redeemed, plus

a make-whole premium.

77