ADT 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7. Commitments and Contingencies

Lease Obligations

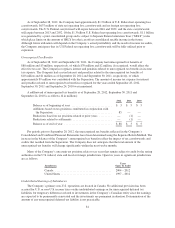

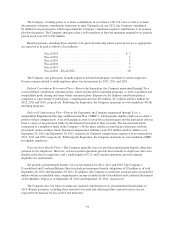

The Company has facility, vehicle and equipment leases that expire at various dates through 2023. Rental

expense under these leases was $44 million, $38 million and $33 million for 2012, 2011 and 2010, respectively.

Additionally, the Company has commitments under capital leases for certain facilities. See Note 5 for further

information on capital lease obligations.

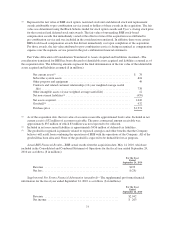

Following is a schedule of minimum lease payments for non-cancelable operating leases as of

September 28, 2012 ($ in millions):

Fiscal 2013 .......................................... $ 44

Fiscal 2014 .......................................... 33

Fiscal 2015 .......................................... 26

Fiscal 2016 .......................................... 12

Fiscal 2017 .......................................... 6

Thereafter ........................................... 24

145

Less sublease income .................................. 11

Total ............................................... $134

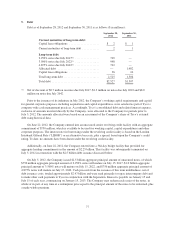

Purchase Obligations

The Company has obligations related to commitments to purchase certain goods and services. As of

September 28, 2012, such obligations were as follows: $37 million in fiscal 2013, $8 million in fiscal 2014 and

$5 million in fiscal 2015.

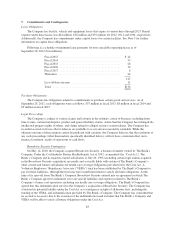

Legal Proceedings

The Company is subject to various claims and lawsuits in the ordinary course of business, including from

time to time, contractual disputes, product and general liability claims, claims that the Company has infringed the

intellectual property rights of others, and claims related to alleged security system failures. The Company has

recorded accruals for losses that it believes are probable to occur and are reasonably estimable. While the

ultimate outcome of these matters cannot be predicted with certainty, the Company believes that the resolution of

any such proceedings (other than matters specifically identified below), will not have a material effect on its

financial condition, results of operations or cash flows.

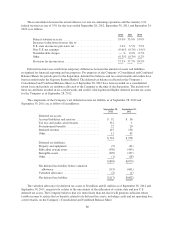

Broadview Security Contingency

On May 14, 2010, the Company acquired Broadview Security, a business formerly owned by The Brink’s

Company. Under the Coal Industry Retiree Health Benefit Act of 1992, as amended (the “Coal Act”), The

Brink’s Company and its majority-owned subsidiaries at July 20, 1992 (including certain legal entities acquired

in the Broadview Security acquisition) are jointly and severally liable with certain of The Brink’s Company’s

other current and former subsidiaries for health care coverage obligations provided for by the Coal Act. A

Voluntary Employees’ Beneficiary Associate (“VEBA”) trust has been established by The Brink’s Company to

pay for these liabilities, although the trust may have insufficient funds to satisfy all future obligations. At the

time of its spin-off from The Brink’s Company, Broadview Security entered into an agreement in which The

Brink’s Company agreed to indemnify it for any and all liabilities and expenses related to The Brink’s

Company’s former coal operations, including any health care coverage obligations. The Brink’s Company has

agreed that this indemnification survives the Company’s acquisition of Broadview Security. The Company has

evaluated its potential liability under the Coal Act as a contingency in light of all known facts, including the

funding of the VEBA, and indemnification provided by The Brink’s Company. The Company has concluded that

no accrual is necessary due to the existence of the indemnification and its belief that The Brink’s Company and

VEBA will be able to satisfy all future obligations under the Coal Act.

83